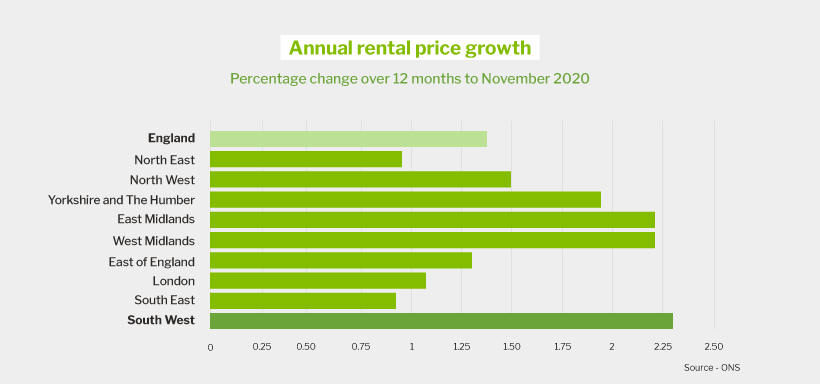

In the year to the end of September 2020, property prices in the South West increased quicker than any other UK region. The rental market has mirrored this purchase demand, with the South West experiencing the steepest rental price increase in England, 2.3%, according to the Office for National Statistics’ (ONS) November 2020 Index of Private Housing Rental Prices.

So, what is drawing people to the area and what does this mean for buy-to-let investors?

One of the South West’s main characteristics is its size. It is the largest of the nine English regions, covering 9,200 square miles. Conversely, the population of 5.2 million places it sixth out of nine regions, making it the least densely populated area in the country.

This open space results in an area with picturesque scenery; Exmoor and the Cotswolds are just two of many inland examples. These are complemented by what many believe to be England’s best beaches, the UK’s longest stretch of coastline interrupted by historic fishing villages and laidback surf towns.

The South West is also home to bustling towns and cities, with the highest proportions of residents concentrated in cities including Bournemouth, Bristol, Plymouth and Swindon. Bristol is also the region’s economic capital, benefitting from its estuary location and links to London via Heathrow Airport along the economically active ‘M4 corridor’.

In the context of industry in particular, the South West could be viewed as one of two halves; alongside the more traditional tourism and agriculture sectors that dominate the southern counties, sectors such as aerospace, advanced engineering and digital industries power the economies in the north and the east of the region. This diversity of industry supports a lower unemployment rate than the UK average and contributes to the gross domestic product that totalled £158 billion in 2018, according to ONS figures.

With the region offering so much, it may come as a surprise to find that the South West is second only to Wales and level with Central London for smallest average landlord portfolio size.

Here we look at some of the reasons that could demonstrate how the region is one of untapped potential.

Tenant demand

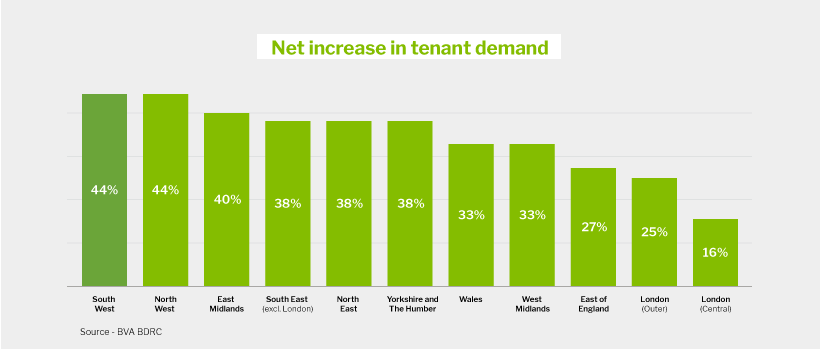

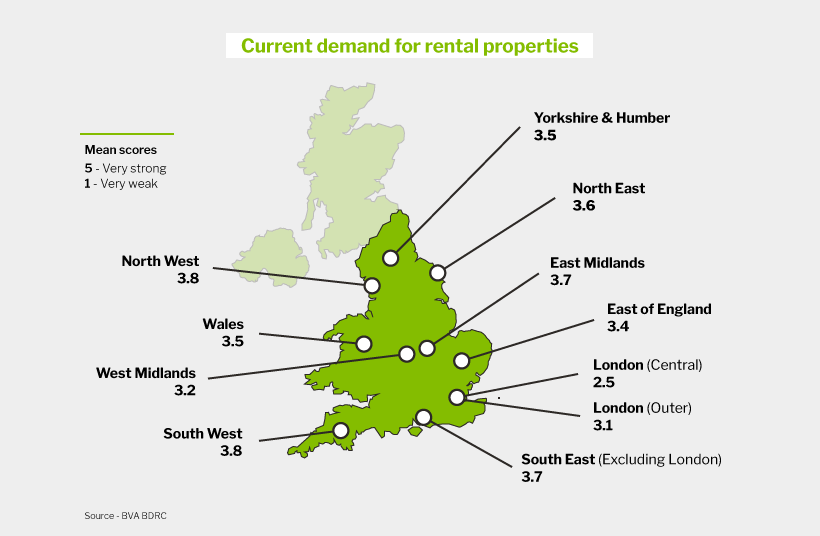

In a Paragon commissioned survey of landlords across England and Wales, the South West was tied in top spot with the North West as the regions seeing the highest increase in tenant demand during Q3 2020, both with a 44% net increase.

This is reflected in the numbers of landlords reporting ‘strong’ demand, with both the South West and North West experiencing the highest average levels of demand in England and Wales.

Some of the factors that may be driving this strong demand include:

Affordability

Looking back over the year we can see that current demand could be a culmination of a longer-term trend in the affordability of property to buy in the South West.

The ONS’ House Price Index showed that in the year to September 2020, the South West was the English region with the highest annual house price growth, with average prices increasing by 6.4% to £275,000.

When this is cross referenced with data highlighting the South West as the UK region experiencing second largest annual fall in earnings, negative growth of 1%, we see that the disparity in household earnings and the cost of purchasing property has increased in the area more over the last year than any other UK region.

More people are relocating to the South West

Increasing numbers of people are relocating to the region, particularly from London. While this is not a new phenomenon, it has almost certainly been accelerated by the Covid-19 pandemic.

Lockdown prompted both homeowners and renters to reassess what is important to them in a home with people placing an increased importance on access to open space, something that the South West has in abundance.

With home working now adopted by many businesses, the need to commute has been reduced. This has severed ties to expensive centrally located properties for some people who are choosing properties in attractive South West locations with some of the UK’s lowest crime rates.

The South West is a tourist hotspot

The South West boasts a strong holiday lets market, fuelled further by Covid-19. With overseas travel significantly stunted due to restrictions at home and abroad, 2020 has seen the rise of the ‘staycation’.

The coasts of Devon and Cornwall share natural beauty with inland spots like the Cotswolds and are joined by world-famous tourist attractions such as Stonehenge to make the South West a long-time firm favourite for domestic holidaymakers. The Great Britain Tourism Survey highlighted the South West as the most visited region in Britain, with 19.1 million domestic trips in 2018.

While it would be difficult to make direct comparisons to 2020, the necessity to holiday in the UK has seen rising property prices in tourist hotspots and may well have a lasting positive effect on the holiday lets market.

South West economy hit by Covid

Whilst the staycation may become a long-term trend, tourism and hospitality were adversely impacted by Covid-19 in 2020. The South West’s economy is unlikely to return to its pre-pandemic levels until 2024 - later than most other areas of the UK – according to consultancy firm EY. Its Regional Economic Forecast shows the West of England is expected to see a 12.2% decline in gross value added (GVA) - a measure of contribution to GDP - in 2020 and will experience a relatively slow rate of growth over the next three years.

Slow economic growth may temper desire or ability to purchase property, adding to tenant demand.

Students in the South West

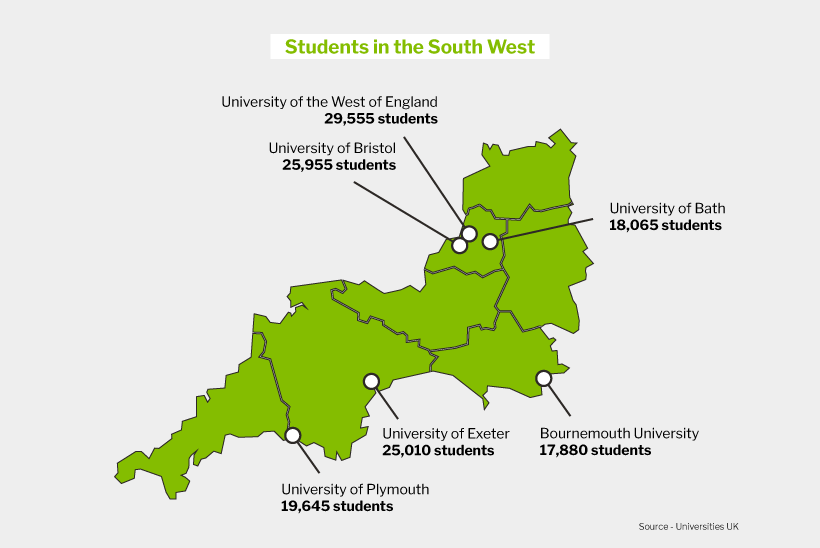

As well as attracting tourists, the region also draws in thousands every year for study – Universities UK figures show that the South West’s higher education institutions attract 74,055 students from the rest of the UK and over 25,700 overseas students.

Alongside homegrown pupils, these numbers are sustaining demand in traditional university towns and cities like Bristol, Bournemouth, Exeter and Plymouth.

The growth of later life renters

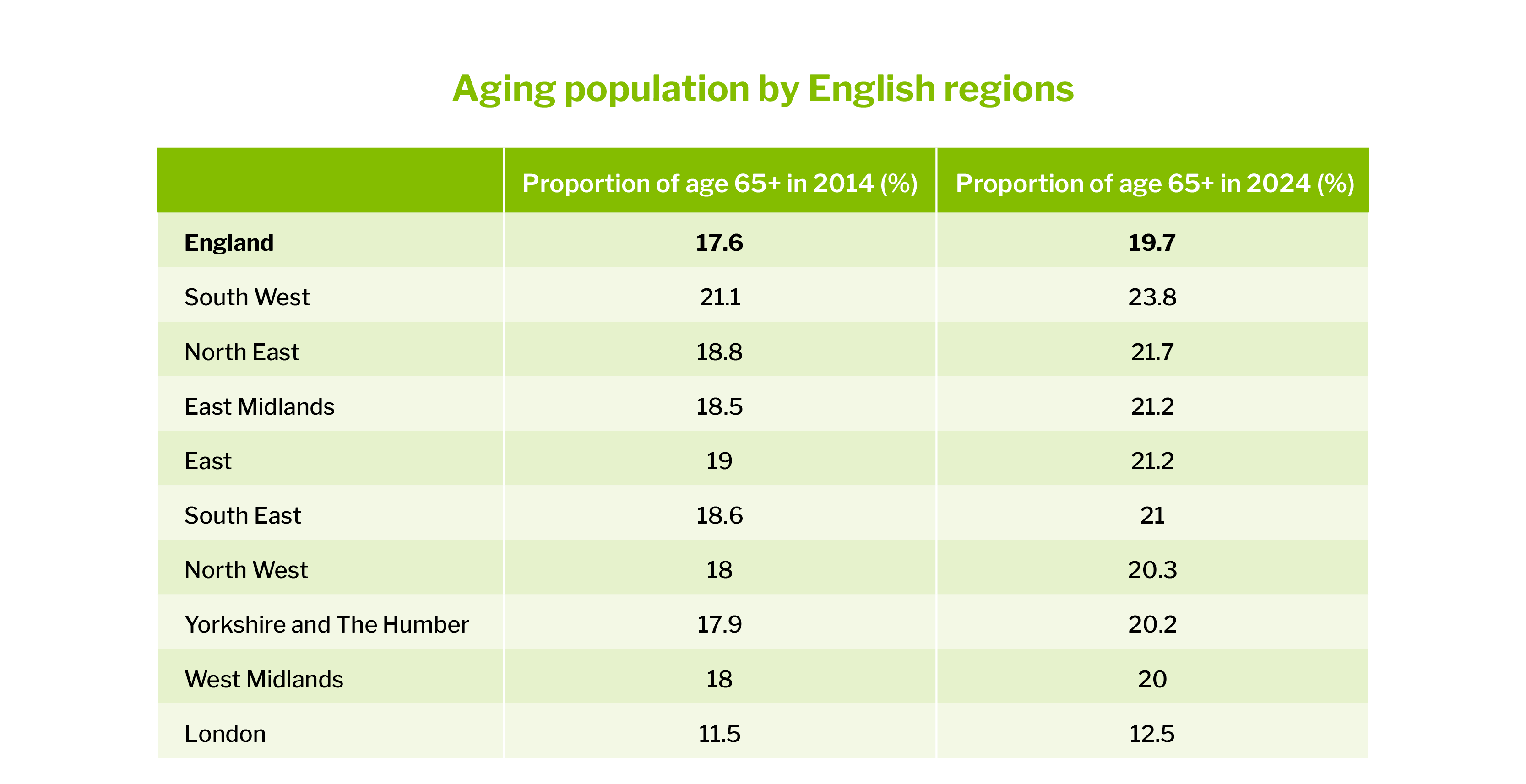

Although the student population increases the chances of seeing young people across the region, 18-24 year olds make up 8.48% of the population, the South West is the UK’s oldest region with the typical age of 43.9 years above the national average of 40.01 years. As illustrated in our report on ‘The growth in later life tenants’, the South West, along with the South East, London and the North West account for the highest number of households in the private rented sector (PRS) where the household representative is aged over 65.

This matters for the buy-to-let industry because the number of over 65s living in privately rented housing has increased by 93% over the last decade. Add to this an ageing population that is set to accelerate, and at a rate greater in the South West than all other English regions, and we can see increasing demand being placed on the supply of social housing and care home beds already struggling to keep the pace.

Rental income generation

With so many factors contributing to strong demand across the South West, it is no surprise that rents have increased over the past year.

The ONS’ November 2020 Index of Private Housing Rental Prices highlighted that the highest annual rental price increase in England of 2.3% was seen in the South West which places it well above the England average of 1.4%.

A number of factors determine how much income can be generated through rent and it is possible that due to its large proportion of rural and coastal properties, the South West is seeing higher demand compared to other regions as a result of the impact of Covid-19.

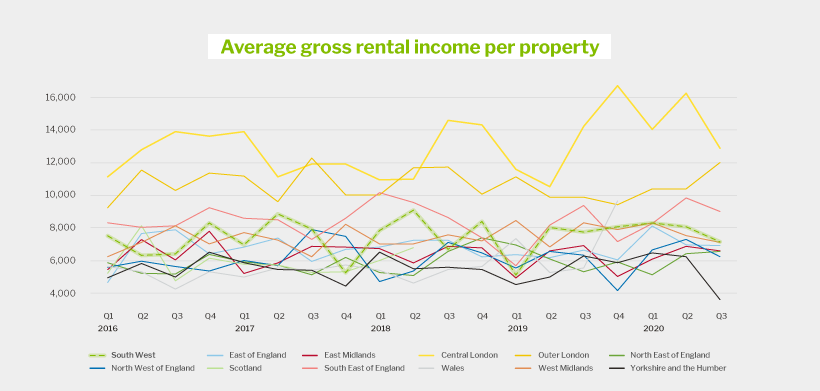

This recent demand has helped to cement the South West’s position as one of the regions where landlords are able to generate the most income per property. Looking back to 2016, we can see that the region has tussled with the neighbouring South East for the highest gross rental income per property outside of London.

Rental yields

It is important to note, however, that the relatively high property prices in the region mean that average rental yields in the South West are currently slightly below the national average of 5.7% at 5.3%.

Houses in Multiple Occupation

In addition to the ability to generate higher rents in desirable coastal locations, the region is also home to in-demand cities, such as Bristol, where the average property price is above the regional average. Here we have recently seen landlords acquiring older properties and converting them into 5 or 6 bed Houses in Multiple Occupancy (HMOs), which can command higher rents due to being renovated to a high standard, boasting facilities such as en-suite bathrooms.

HMOs are also consistently ranked amongst the property types able to generate the highest yields and the South West, along with London and the North West, has the highest proportion of landlords owning these after the West Midlands.

Tenant types

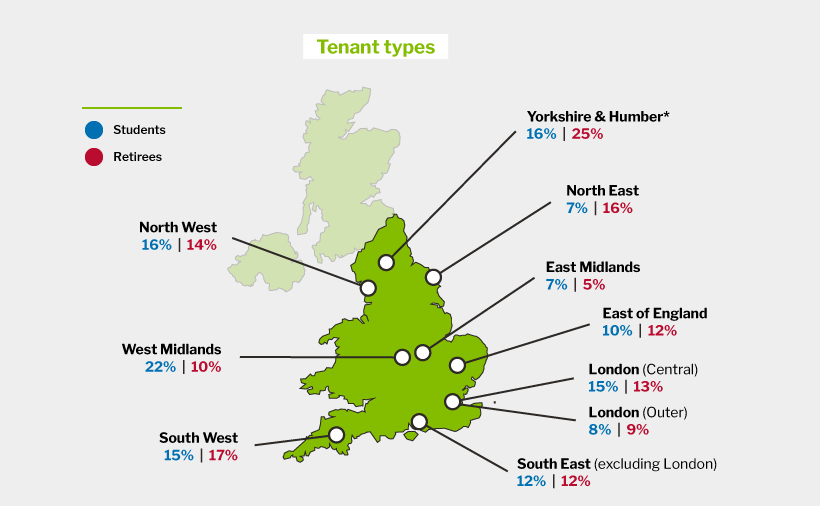

Looking again at tenant types, we see that they are also a determinant of rental income generation. Landlords letting to students indicated that they achieved the highest rental yields and even though those operating in the West Midlands let to the highest proportion of students in England at 22%, students make up 15% of tenants for landlords across the South West, which is 3 percentage points more than the national average.

Retirees generate the second highest rental yields and unsurprisingly, owing to its high number of over 65s, landlords in the South West reported the largest proportion of retiree tenants.

Regional outlook

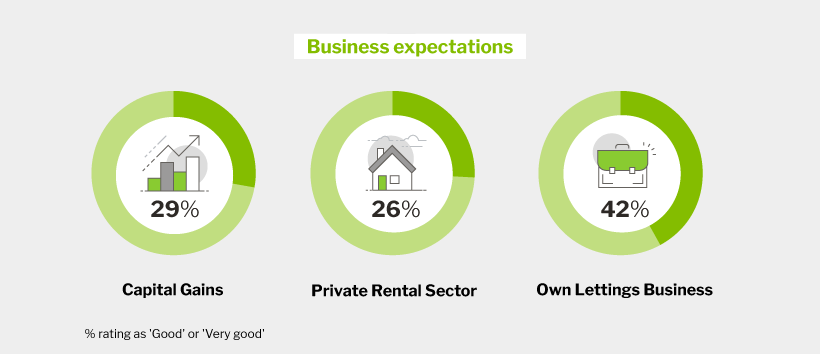

Landlords in the South West are the most optimistic about the future. When compared to those in other regions, South West landlords were positive about more aspects of their business, expecting the future to be ‘Good’ or ‘Very good’ for ‘Capital Gains’, ‘Private Rental Sector’ and ‘Own Lettings Business’.

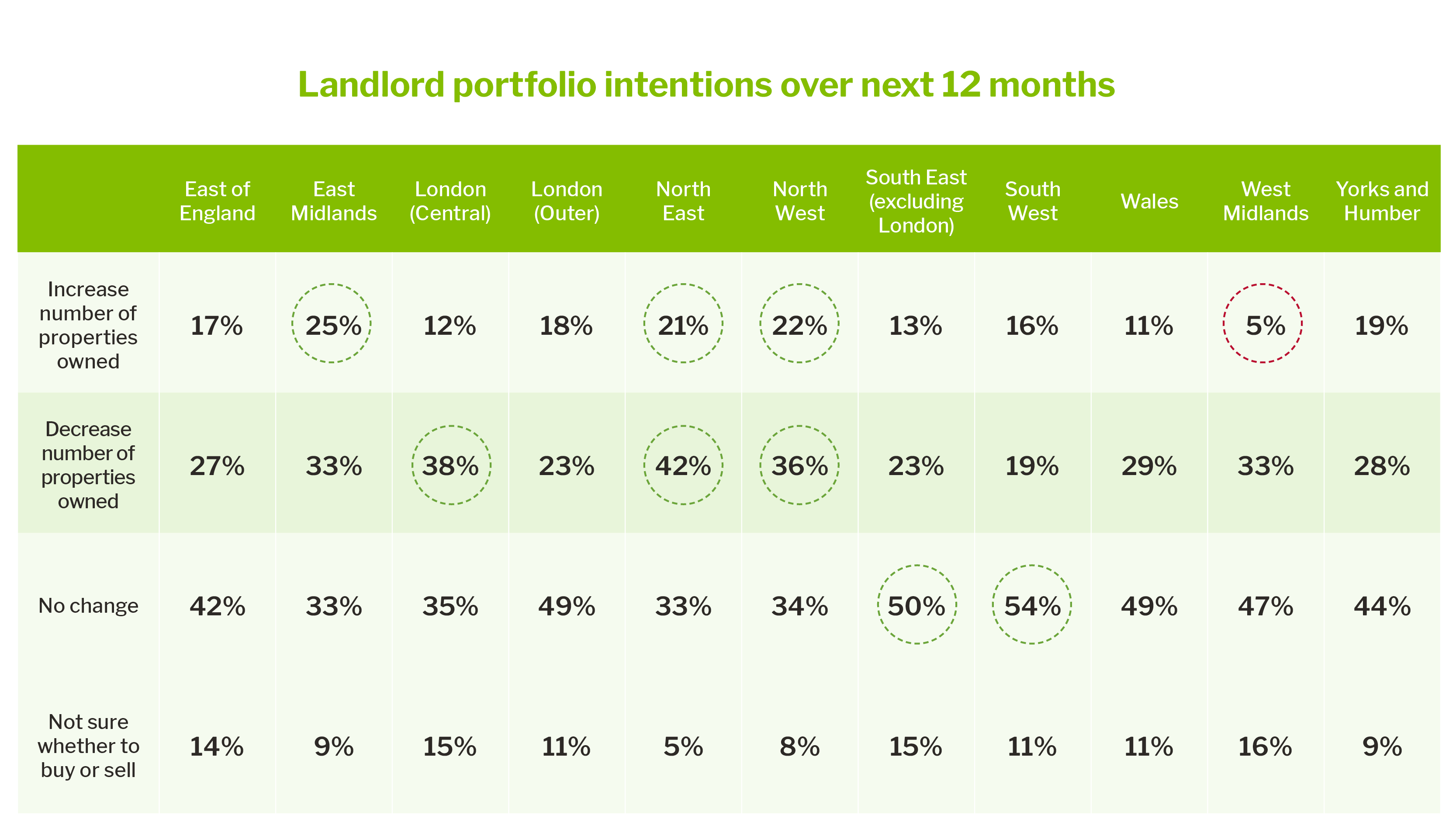

This positive outlook is contributing to stability in the region’s private rented sector; the region has the highest number of landlords - 54% - expecting ‘no change’ when asked if they intend to buy or sell in the next 12 months.

Whilst landlords may be looking for more economic certainty before adding to their portfolios, the region’s various strengths and opportunities for growth make the South West an attractive area for investment.