Nearly one in five tenants rank permission to keep pets in their top three priorities for renting a home, Paragon Bank research has found.

A report by the Social Market Foundation (SMF), Where next for the private rented sector?, has highlighted how 18% of tenants place the permission to keep pets in the top three priorities for their rented home.

For the report, SMF surveyed over 1,300 renters, asking them to share what they look for in a property. Despite the high proportion of pet loving tenants, Government statistics show only 7% of landlords market their properties as pet friendly1.

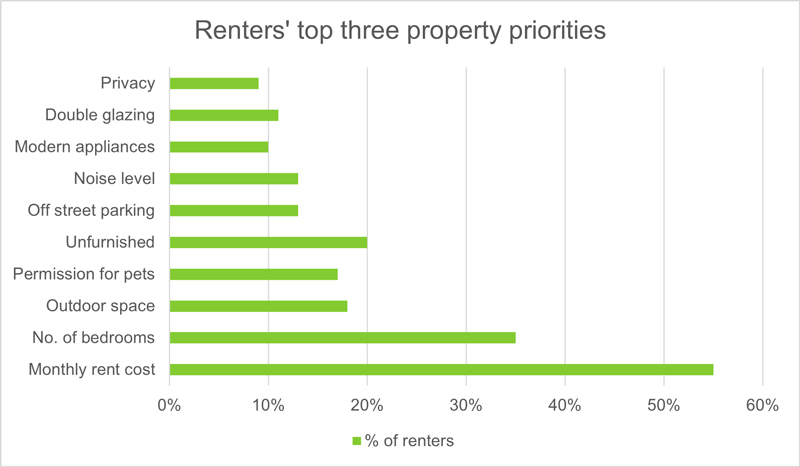

The most important consideration for tenants is the monthly rent cost, a top three priority for over half (55%) of those surveyed. This was followed by property size, in terms of the number of bedrooms, which is prioritised by 35% of renters.

As well as these fundamental facets of housing, the survey shows that when thinking about how a home meets their needs, renters value aspects that help to enhance their experience, with outdoor space alongside permission to own pets in the list of top three property priorities.

Tenants were also asked what is important about the area in which rented accommodation is located. Being close enough to work was a priority for just under one-in-four renters (38%), closely followed by public transport facilities (37%) and shops (36%).

Richard Rowntree, Mortgages Managing Director for Paragon Bank said: “It is unsurprising that the monthly rent cost is the top consideration for tenants. With a shortage of stock seen alongside high demand for privately rented homes, this need for affordable housing reinforces the importance of investment in the private rented sector.

“It was interesting to see the value that renters place on the things that help to shape their everyday lives, such as keeping pets and outside space. The SMF study showed that tenants are likely to stay in a property for the long-term and they want to make it a real home, so we would encourage landlords to consider how they can facilitate that.

“In the current economic climate, we’re likely to see further pressure on rents but it is encouraging to know that there are things that landlords can do to improve the experience of renters. By listening to tenants and working to meet their needs, we can help to provide houses that people will be happy to call home which benefits the renters, landlords and wider community.”

For further information contact:

Jordan Lott

Media Relations Manager

Paragon

Tel: 0121 712 2319

www.paragonbank.co.uk

Notes to editors:

1. Advocats: https://www.advocatseastmids.org.uk/westminister/

The report, Where next for the private rented sector?, was published at 08:30 AM on 14 March 2022 at smf.co.uk/publications/future-of-private-rented-sector/

SMF surveyed over 1,300 UK adults who currently live in rented accommodation. Surveys were distributed by Opinium

This report was sponsored by Paragon Bank. The SMF retained complete editorial independence

Paragon lends to private individuals and limited companies and has mortgages suitable for single, self-contained properties, as well as HMOs and multi-unit blocks. Paragon can accommodate higher aggregate lending limits and more complex letting arrangements including local authority leases and corporate leases along with standard ASTs.

Paragon introduced its first product aimed at the professional property investor in 1995 and is a member of UK Finance, the Intermediary Mortgage Lenders Association (IMLA), National Landlords Association (NLA) and the Association of Residential Letting Agents (ARLA).

Paragon Bank PLC a subsidiary of the Paragon Banking Group PLC which is a FTSE 250 company based in Solihull in the West Midlands. Established in 1985, Paragon Banking Group PLC has over £12 billion of assets under management and manages over 450,000 customer accounts.

Paragon Bank PLC is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. Registered in England number 05390593. Paragon Bank PLC is registered on the Financial Services Register under the firm reference number 604551. Registered office 51 Homer Road, Solihull, West Midlands B91 3QJ.