Paragon Bank's final PRS Trends report of what few would disagree was an extraordinary year, was set against a backdrop of a positivity due to the commencement of a Covid-19 vaccination programme.

Although tempered by a third national lockdown, when combined with factors such as the strong tenant demand seen in most parts of the UK and stable yields, we have returning levels of landlord confidence and reassurance of the sector's resilience.

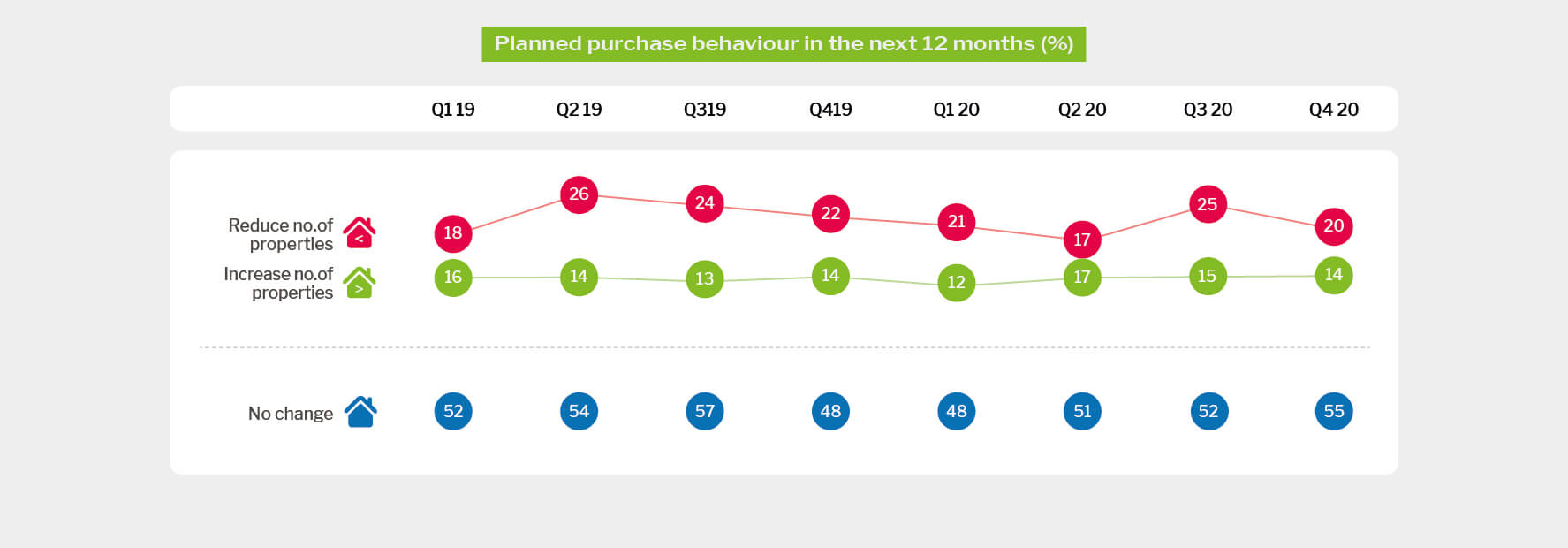

Looking forward, we see that the percentage of landlords intending to buy has remained stable and those looking to sell has also stabilised following the high seen in Q3. The types and locations of planned purchases also remains consistent with what we have seen in the past.

This indicates that despite the huge challenges posed by Covid-19, landlords are looking at long-term trends and making measured investment decisions that help to reinforce buy-to-let's place as a key facet of UK housing.

Richard Rowntree

Managing Director - Mortgages

Property portfolio sizes

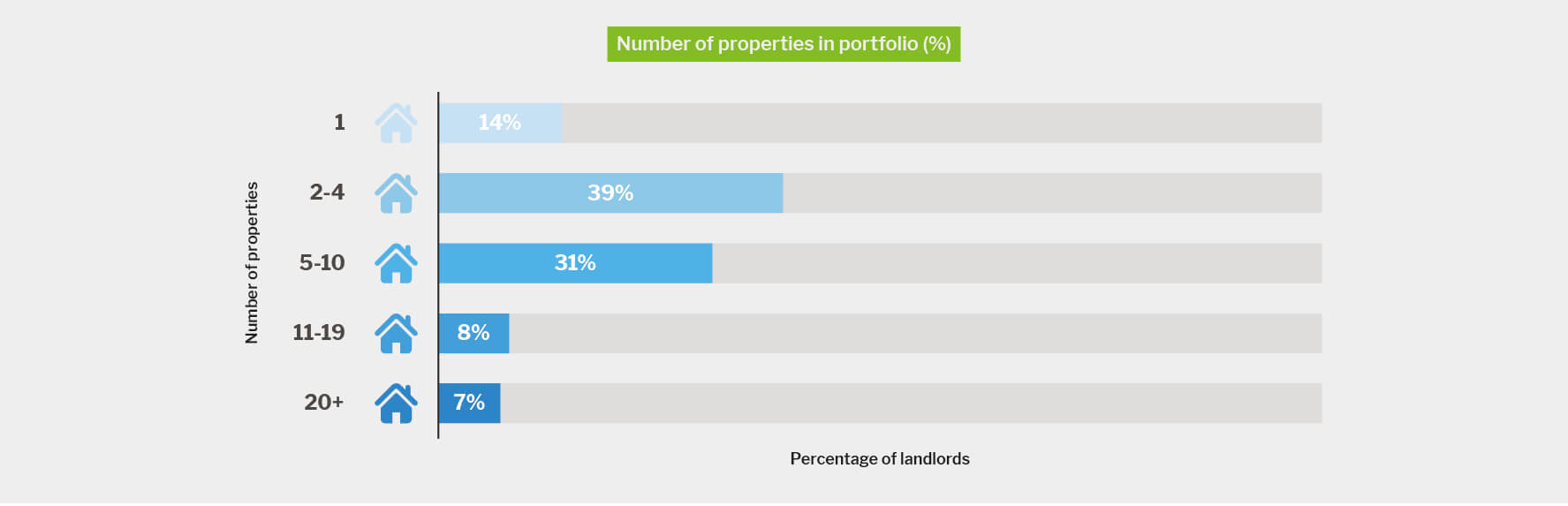

Following a small dip of 0.3 properties from Q3, the average portfolio now has 7.8 properties. This, represents 10.4 tenancies on average, due to some properties, such as HMOs, housing multiple tenancies.

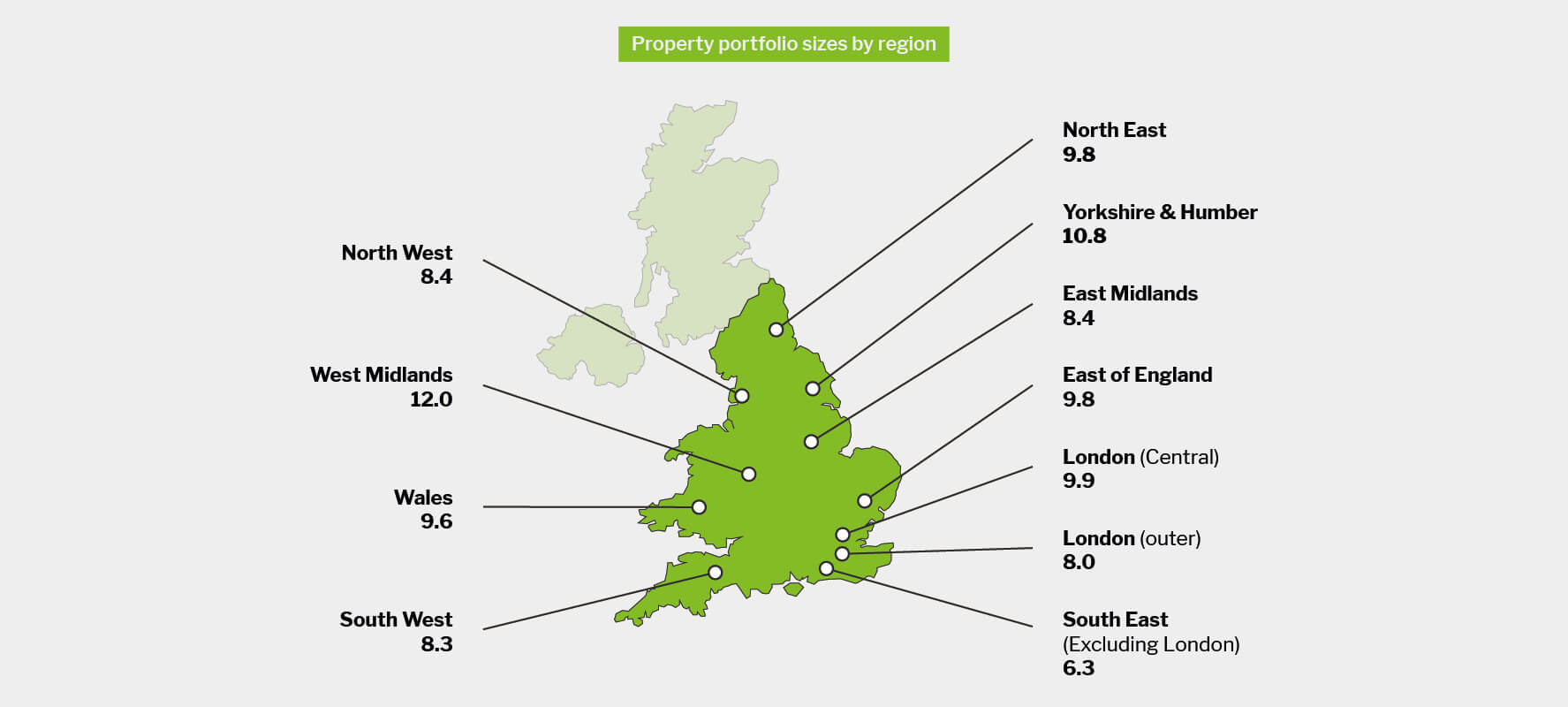

With a total average of 12 properties each in Q4, landlords in the West Midlands were managing the largest portfolios. The smallest portfolios, consisting of an average of 6.3 properties, were owned by landlords in the South East, which excludes London in this case.

Property portfolio ownership structure

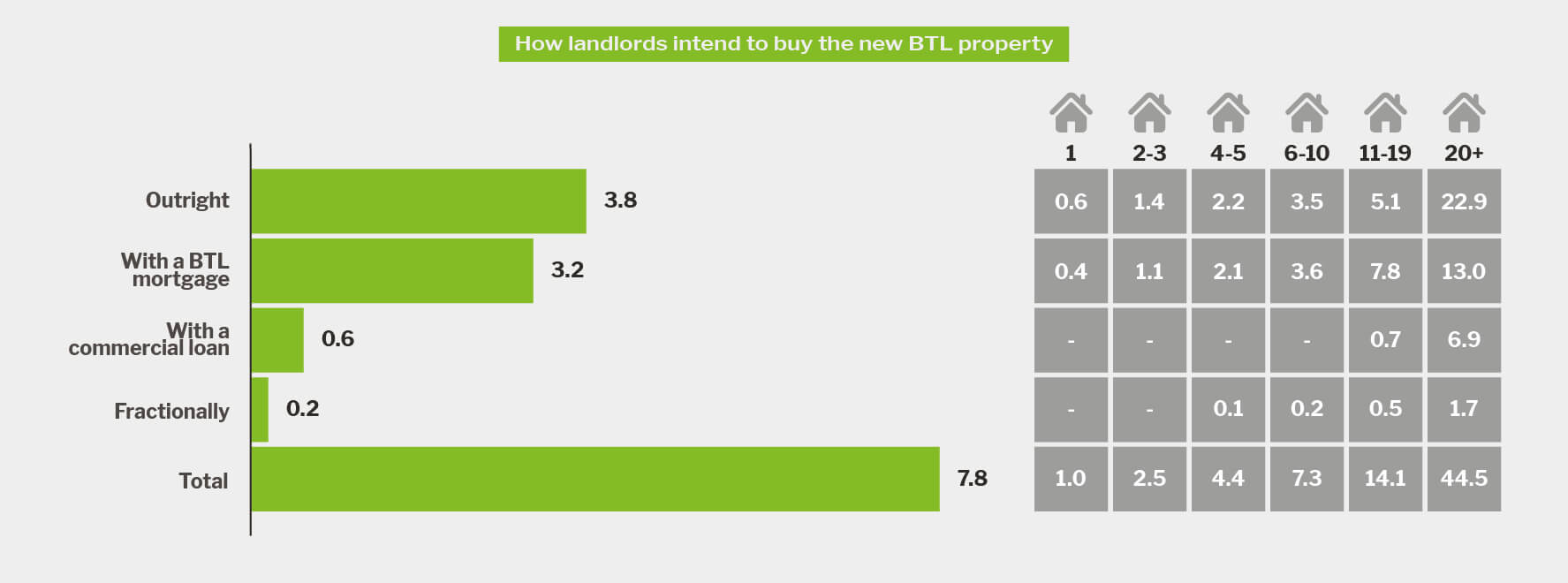

Considering the average BTL portfolio, an average of 3.8 properties are owned outright, making it the most common type of ownership structure. This is followed by properties owned through BTL mortgage lending, an average of 3.2 properties.

Portfolios contain an average of 0.6 properties funded through commercial loans and fractionally owned account for just 0.2 properties.

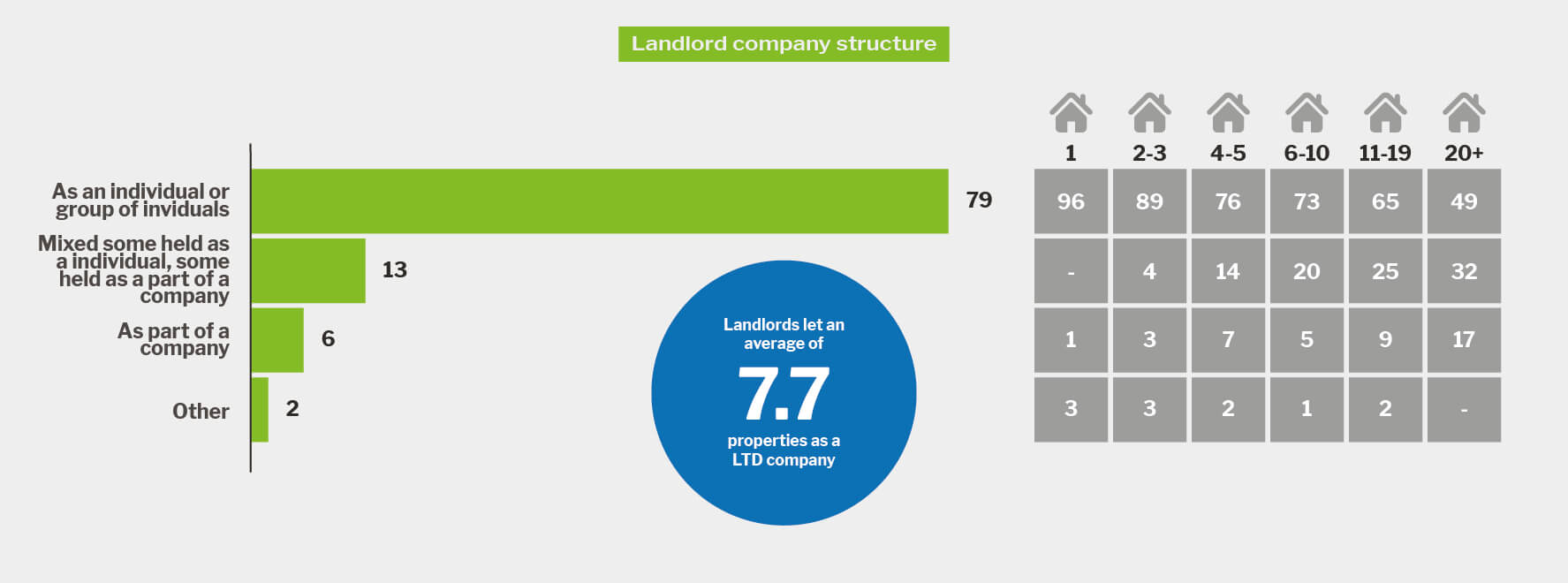

While letting properties as an individual is most common, there has been a small increase from 17% in Q3 to 19% in Q4 in the proportion of landlords that hold at least some of their portfolio within a limited company.![]()

Operating through a limited company is significantly more prominent amongst landlords with 20 or more properties, with the proportion rising to 49%.

Those who do own properties within a LTD company have an average of 7.7 held in this way.

Tenant demand

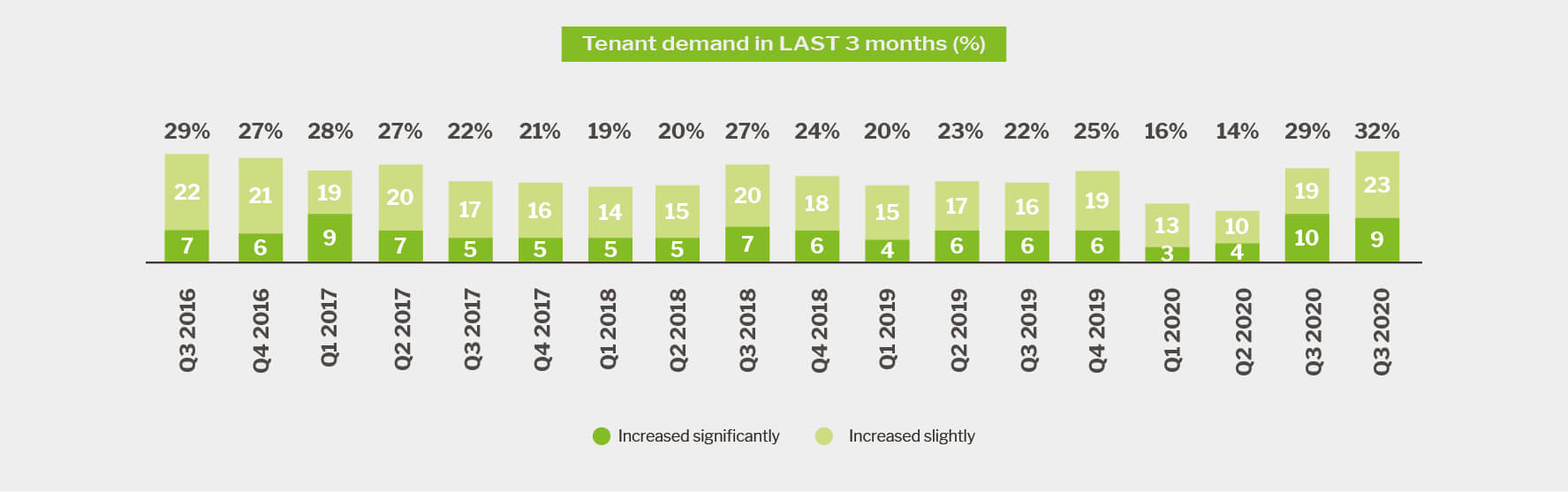

Strong demand remains in Q4 2020 with the highest proportion of landlords reporting an increase in tenant demand in the last 3 months since Q1 2016.

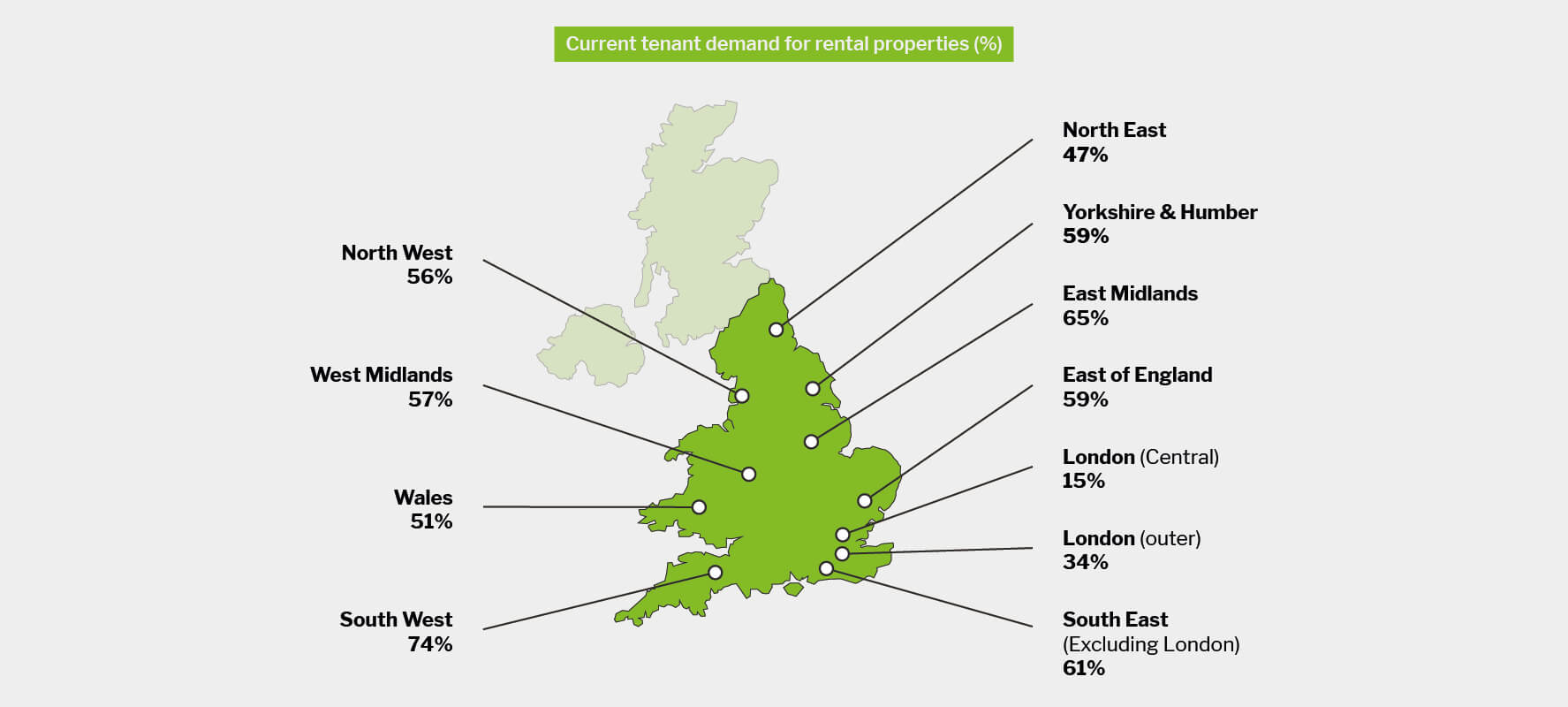

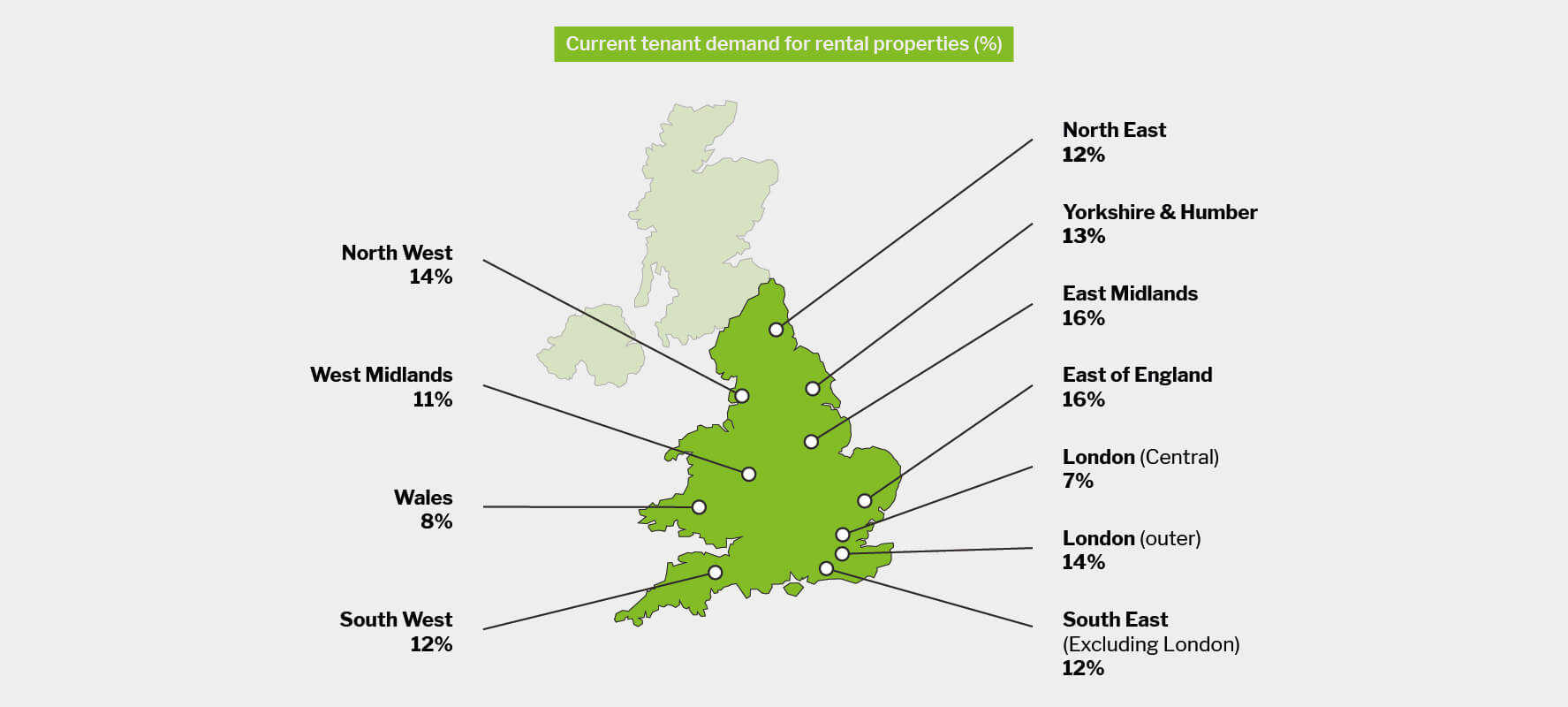

Looking at tenant demand regionally, strong current demand is most likely to be experienced by landlords operating in the South West and the East Midlands, at 74% and 65% respectively.

At the other end of the scale, current demand in Central London has hit an all-time low as 54% of landlords with properties in that market state that demand is ‘weak’. One third of landlords operating in Outer London have also experienced weak demand.

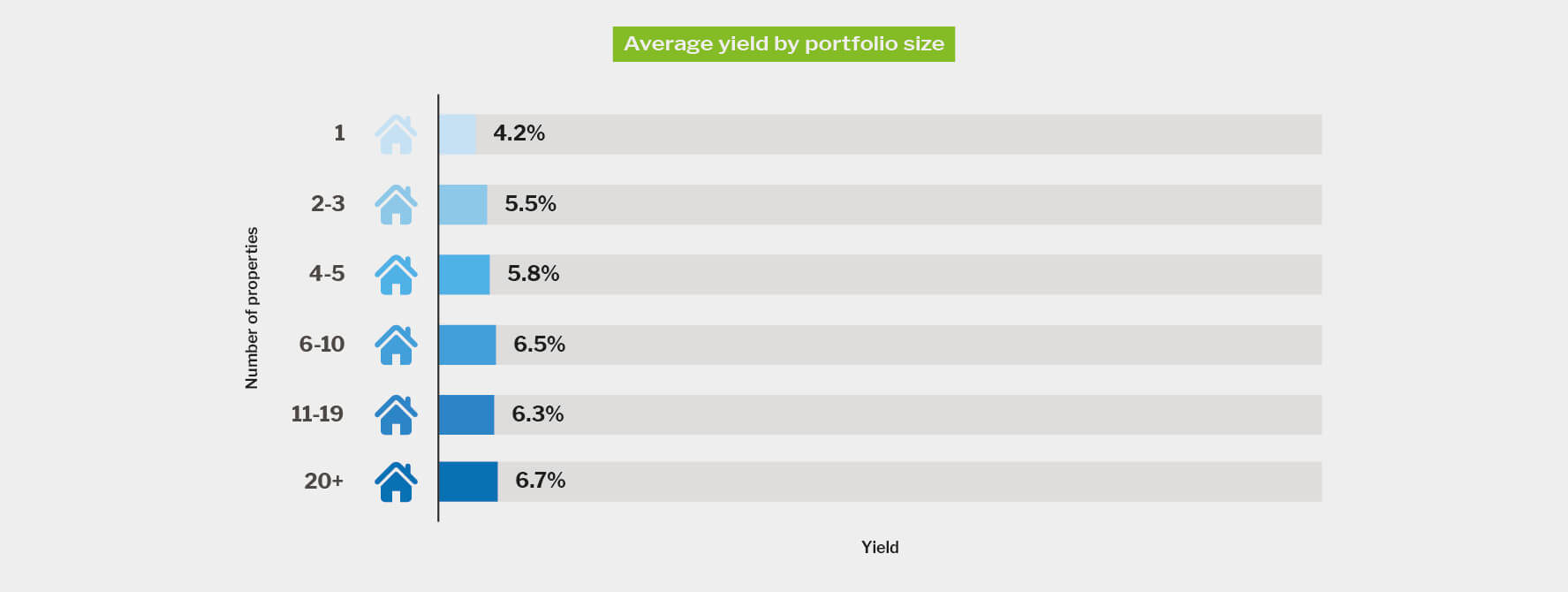

Yield generation

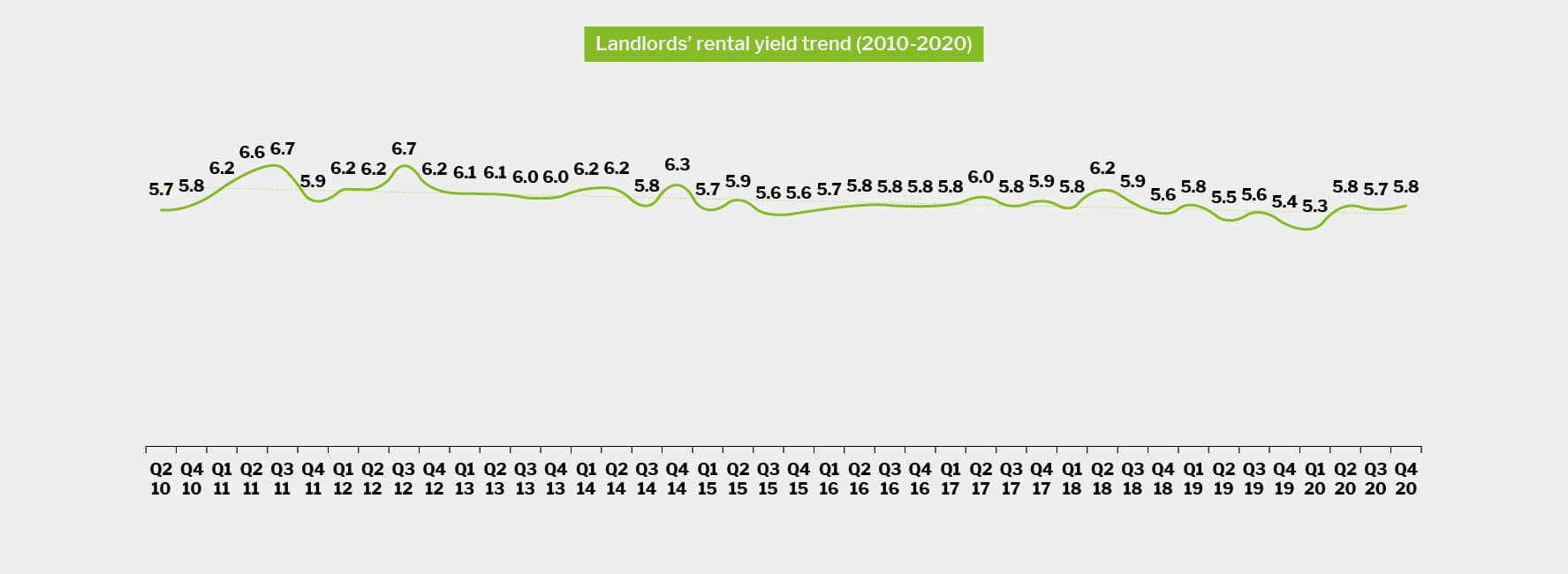

Average rental yields remain stable at 5.8%.

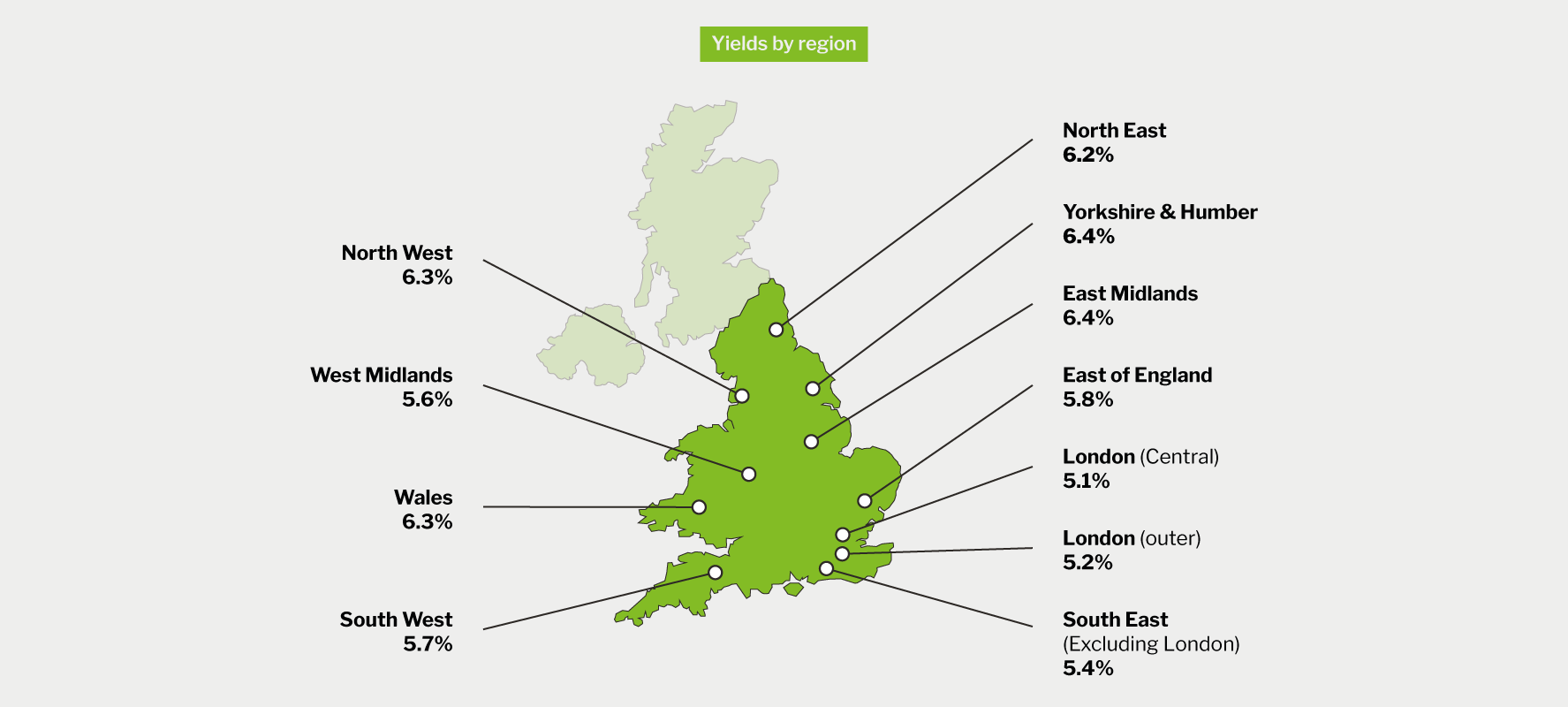

Currently, the highest yields of 6.4% are achieved by landlords operating in Yorkshire and The Humber and the East Midlands. In line with the weak demand currently being reported, landlords with property in Central London are generating the lowest yields of 5.1%.

The typical yield generated tends to increase in line with portfolio size, with single property landlords achieving an average yield of just 4.2% vs. the 6.7% achieved by 20+ property landlords.

HMO lettings continue to generate significantly higher average rental yields compared to other property types (7.0%).

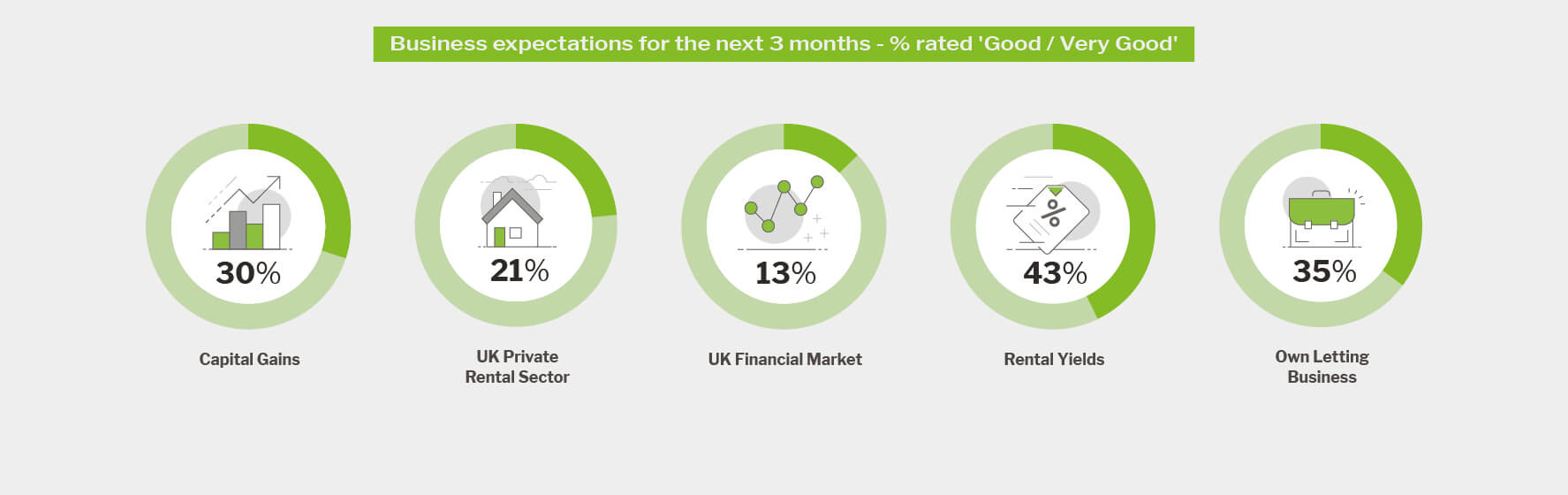

Landlord business expectations

Despite the challenges posed by the Covid-19 pandemic, landlord confidence at the end of 2020 was higher than Q4 2019, when we look at four out of five key optimism indicators.

When asked about their business expectations for the next three months, 13% of landlords rated the prospects for the ‘UK Financial Market’ as either ‘Good’ or ‘Very Good’. Although this is an improvement from last quarter and the historic low of 3% seen at the start of 2020, it is a downturn on the 24% recorded in Q4 2019.

Portfolio intentions

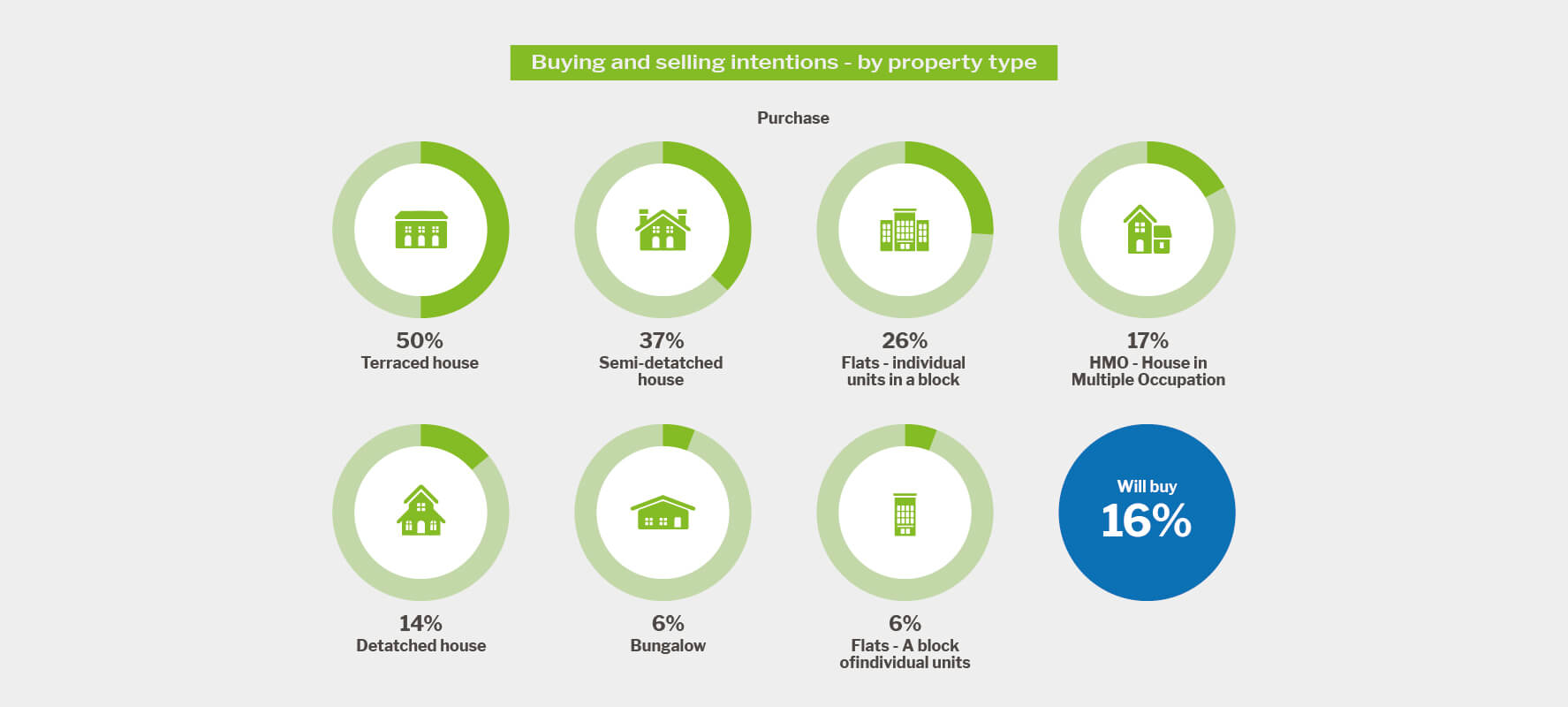

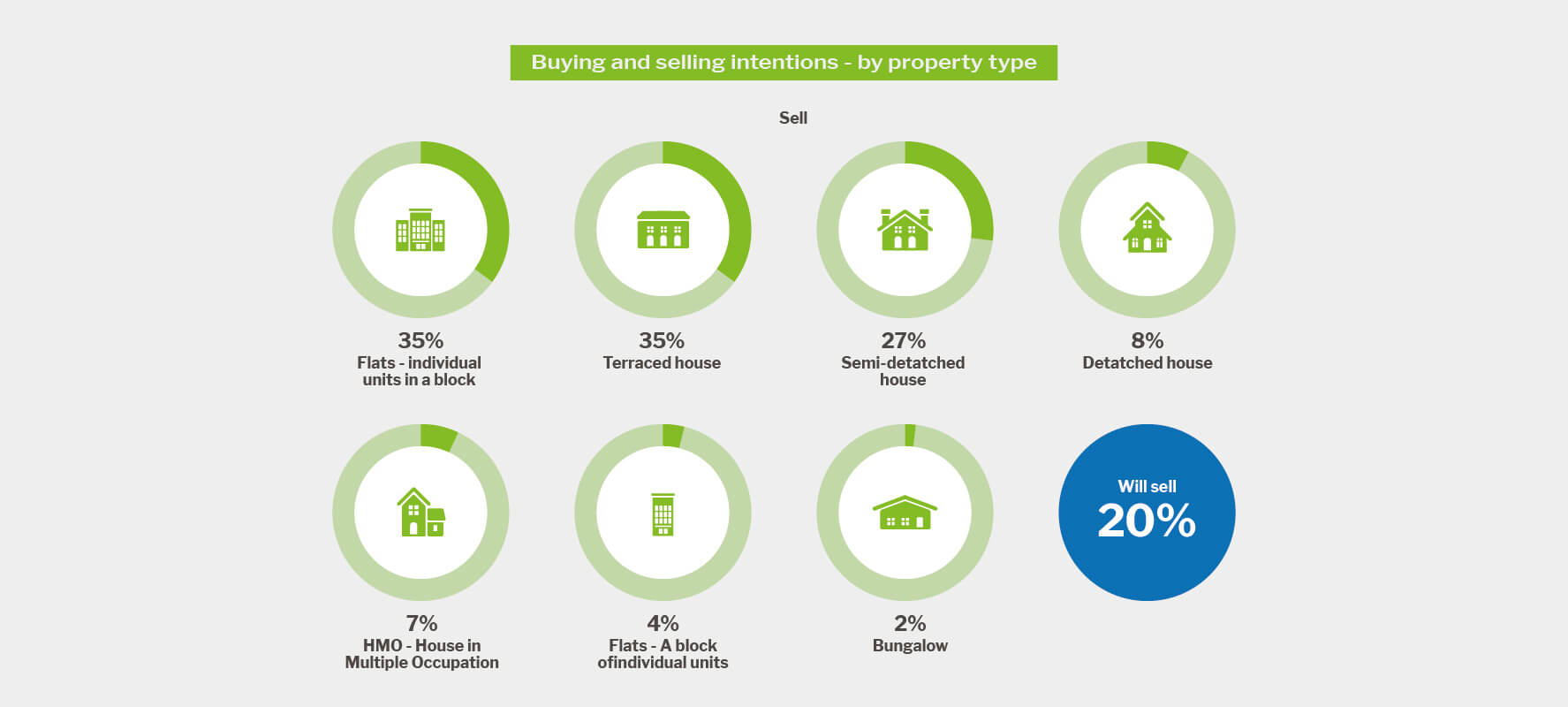

There has been a slight increase from 15% in Q3 2020 to 16% in Q4 in the proportion of landlords intending to buy in the next 12 months. The number of landlords who intend to sell has stabilised, falling from the 2020 peak of 25% reported last quarter to 20% in Q4.

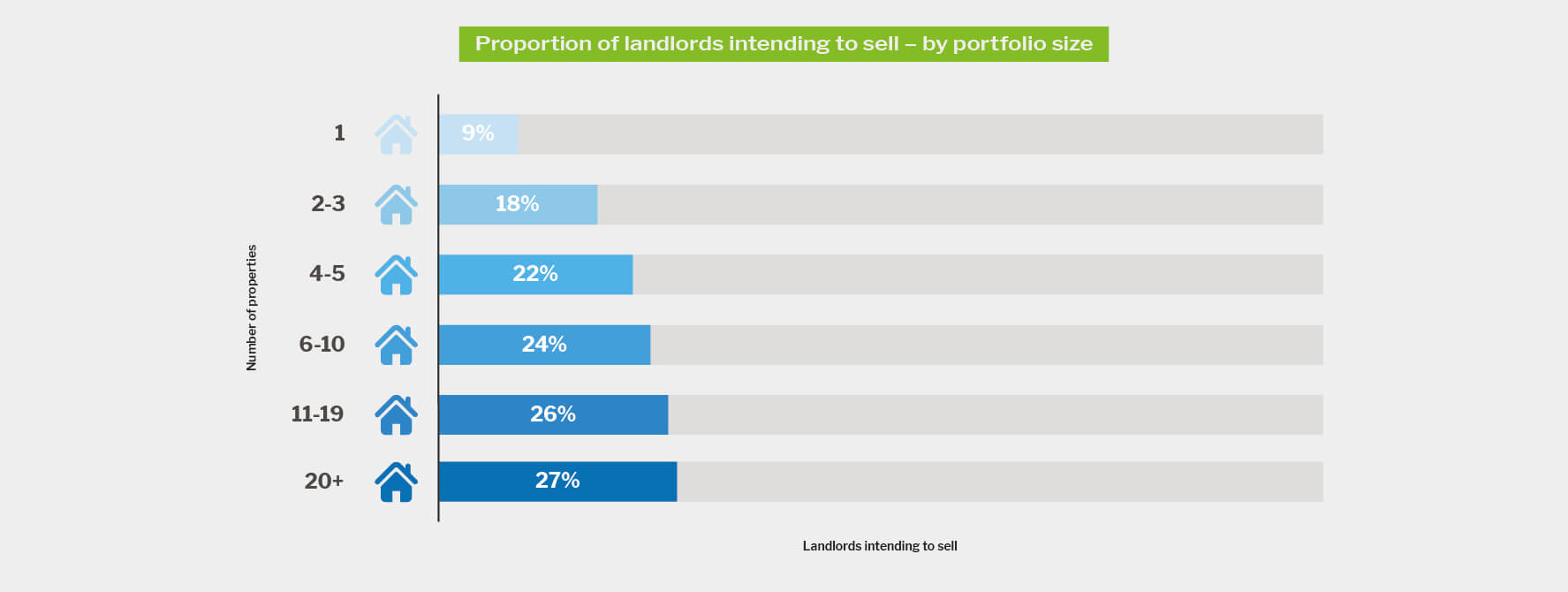

One of the most striking findings of this report is the significant drop in the proportion of landlords with 20 or more properties who intend to reduce their portfolios, falling from 46% in Q3 2020 to 27% in Q4.

One of the most striking findings of this report is the significant drop in the proportion of landlords with 20 or more properties who intend to reduce their portfolios, falling from 46% in Q3 2020 to 27% in Q4.

Landlords operating in the North West, Wales and Central London are most likely to be active in the BTL property market in the next year, with around half planning to either buy or sell.

Terraced houses top the wish lists of the highest proportion of landlords looking to expand their portfolios in the next 12 months. Along with individual flats, terraced houses are also the most popular property type to sell.

Property purchase locations

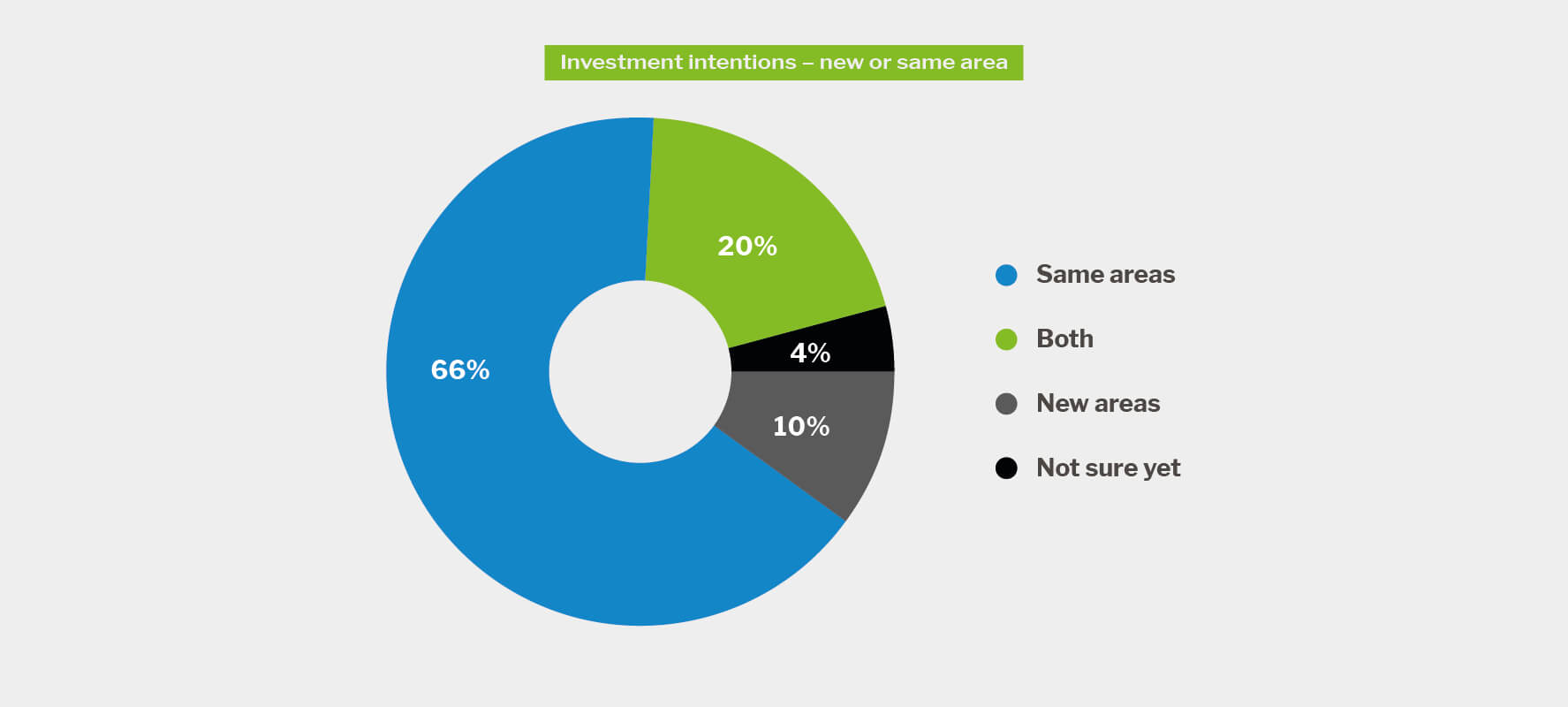

Landlords who intend to invest in the next year have indicated that they will do so in the same area as existing property in most cases.

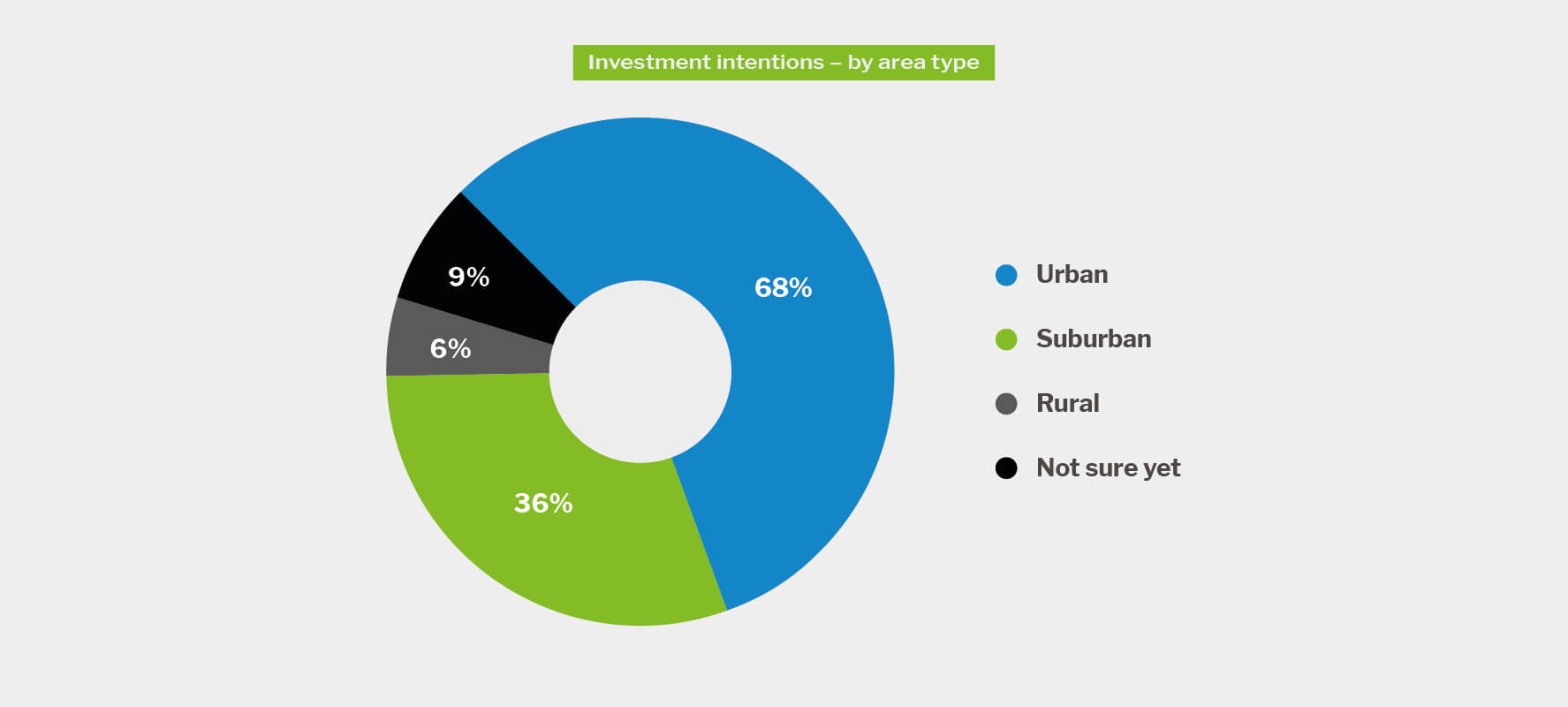

Despite questions on whether the Covid-19 pandemic would lead to a ‘de-urbanisation’ – a shift away from built up areas as a result of a reduced requirement to live close to city-based workplaces and an increased desire for access to green space - two thirds plan to buy BTL property in urban areas, just over one in three in suburban areas and only 6% in rural areas.

Key attributes in new investment properties

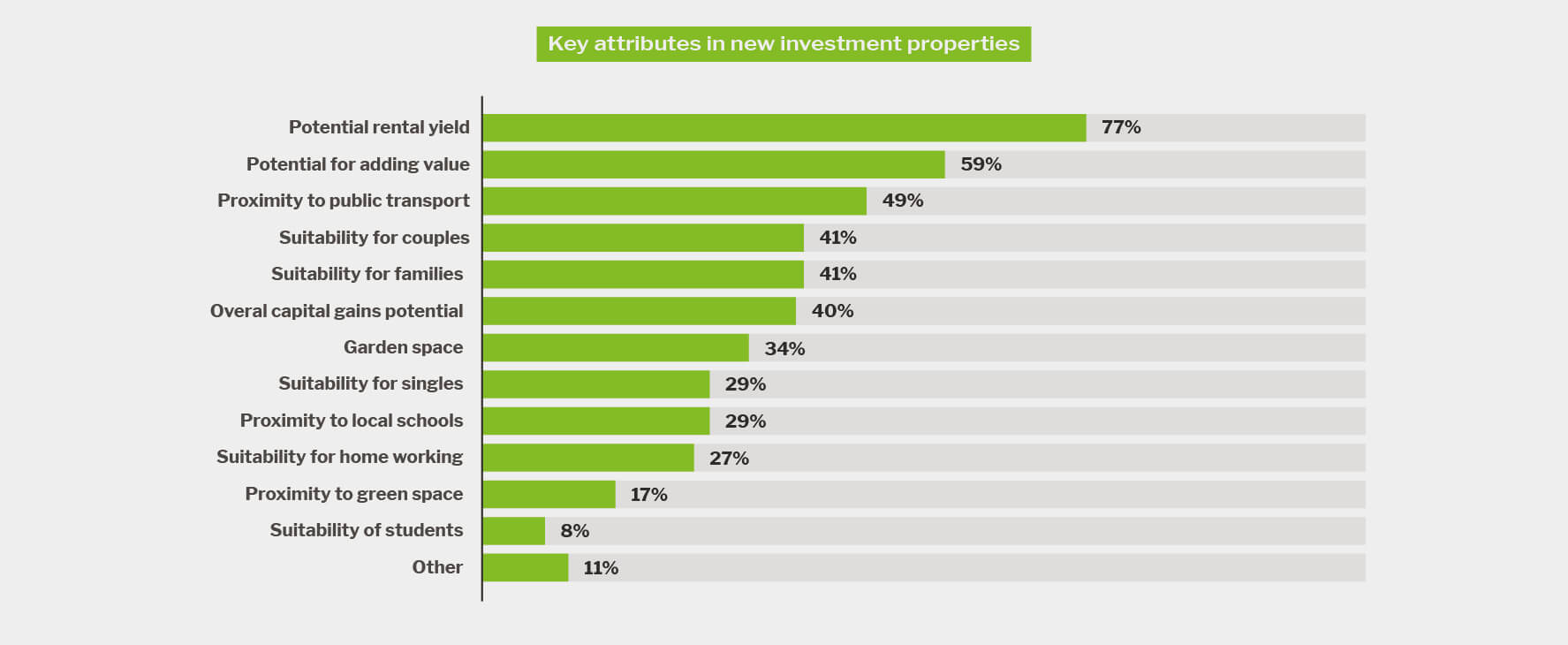

When purchasing new BTL properties, the potential for generating rental yields is the key attribute most (77%) landlords look for.

The potential to add value is the next most important characteristic, chosen by 59% of landlords, followed by the proximity to public transport, a key attribute for 49%.

Making up the top five, landlords are also considering how suitable properties are for families and couples, both a key attribute for 41% of landlords.

The research suggests that landlords are considering the impact of the Covid-19 pandemic on tenant property priorities but are favouring a strategy that looks at the broader characteristics of the market; garden space, suitability for working from home and proximity to green space all appear lower down the list of key attributes.

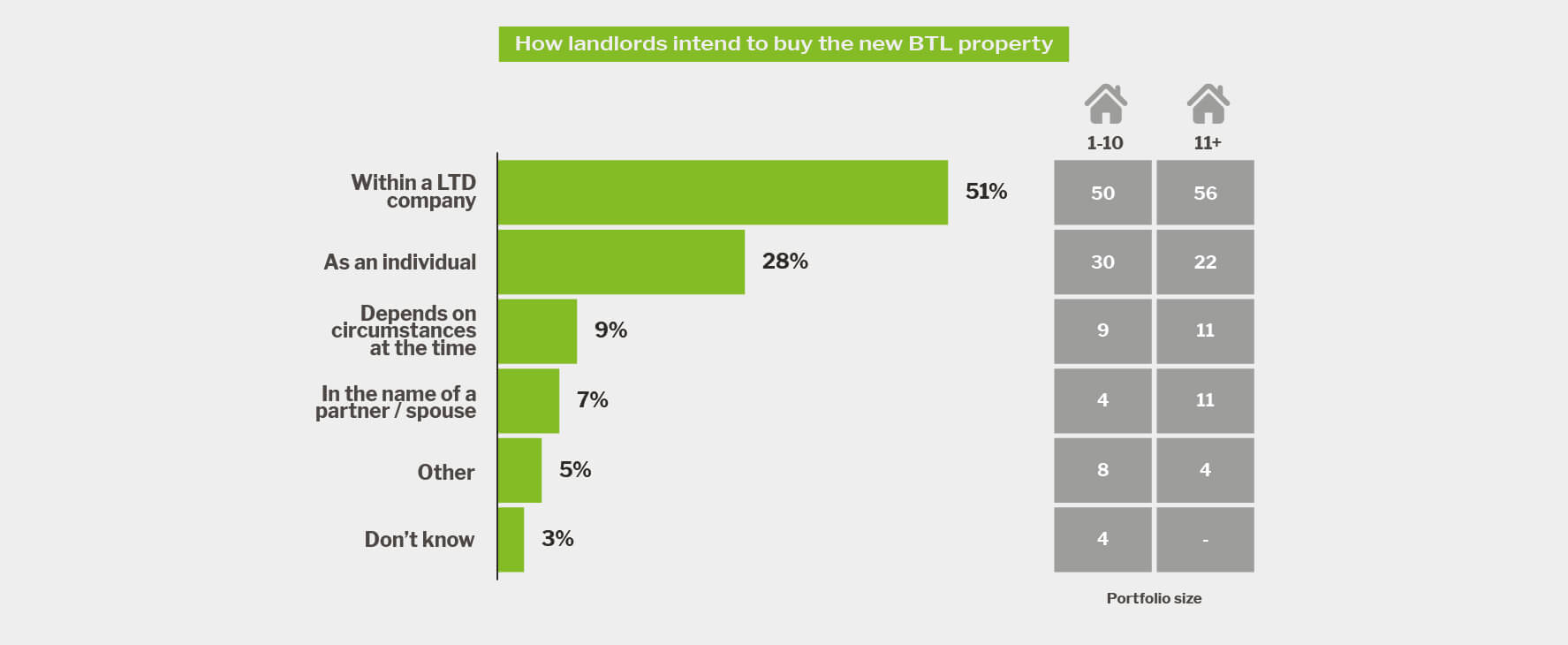

The proportion of landlords planning to make their next BTL purchase as an individual has fallen by 9 percentage pointspts to 28% in Q4. An increase in the number of those who are operating through limited companies means that landlords with 11 or more properties are now only slightly more likely than their smaller counterparts to buy their next BTL property within in a limited company (56% vs. 50%).

To develop the Q4 PRS Trends report, we worked alongside research agency BVA BDRC. Between December 2020 and January 2021, they gained insight through in-depth interviews with just under 850 landlords, in partnership with the National Residential Landlords Association (NRLA).