Private Rented Sector (PRS) Trends- Q1 2021

The first Private Rented Sector (PRS) Trends report of 2021 is a particularly interesting edition because it provides us with the opportunity to draw comparisons between the sector at the start of the Covid-19 outbreak a year ago and the present day.

This report highlights some real positives, with continued levels of strong tenant demand contributing to average rental yields hitting a three-year high.

These, along with changes to the macro environment such as the success of the UK’s Covid-19 vaccination programme and the easing of lockdown measures, are likely to be factors driving the elevated levels of landlord confidence, which have also hit a three-year high.

In turn, this sense of optimism appears to have impacted investment appetite because more landlords have told us that they plan to expand their portfolios than reduce, the first time in over four years that this has been the case.

Additional investment in the sector is great news because more stock means more choice for tenants and, because the majority of landlords plan to finance purchases with buy-to-let mortgages which are stringently assessed by lenders, it also helps to raise property standards.

Richard Rowntree, Managing Director for Mortgages

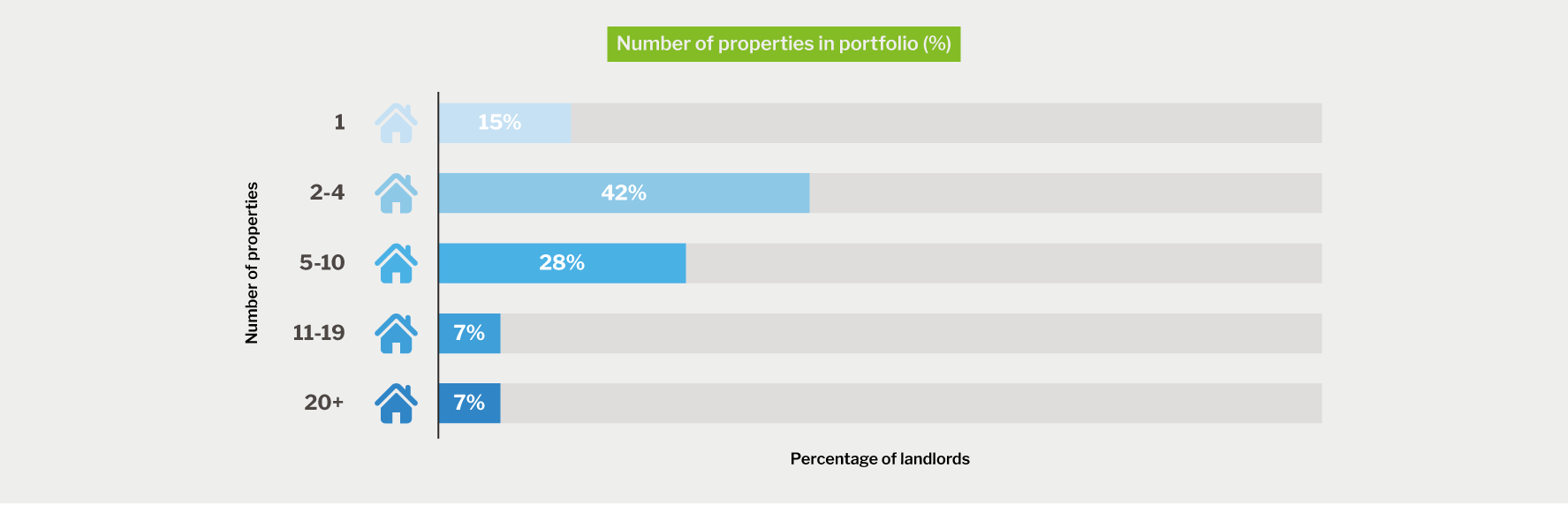

Property portfolio sizes

The average portfolio is currently made up of 7.3 properties, down from 7.7 at the start of 2020, with each property typically valued at £168,000 and generating an annual income of around £7,397 per property, or £616 per calendar month.

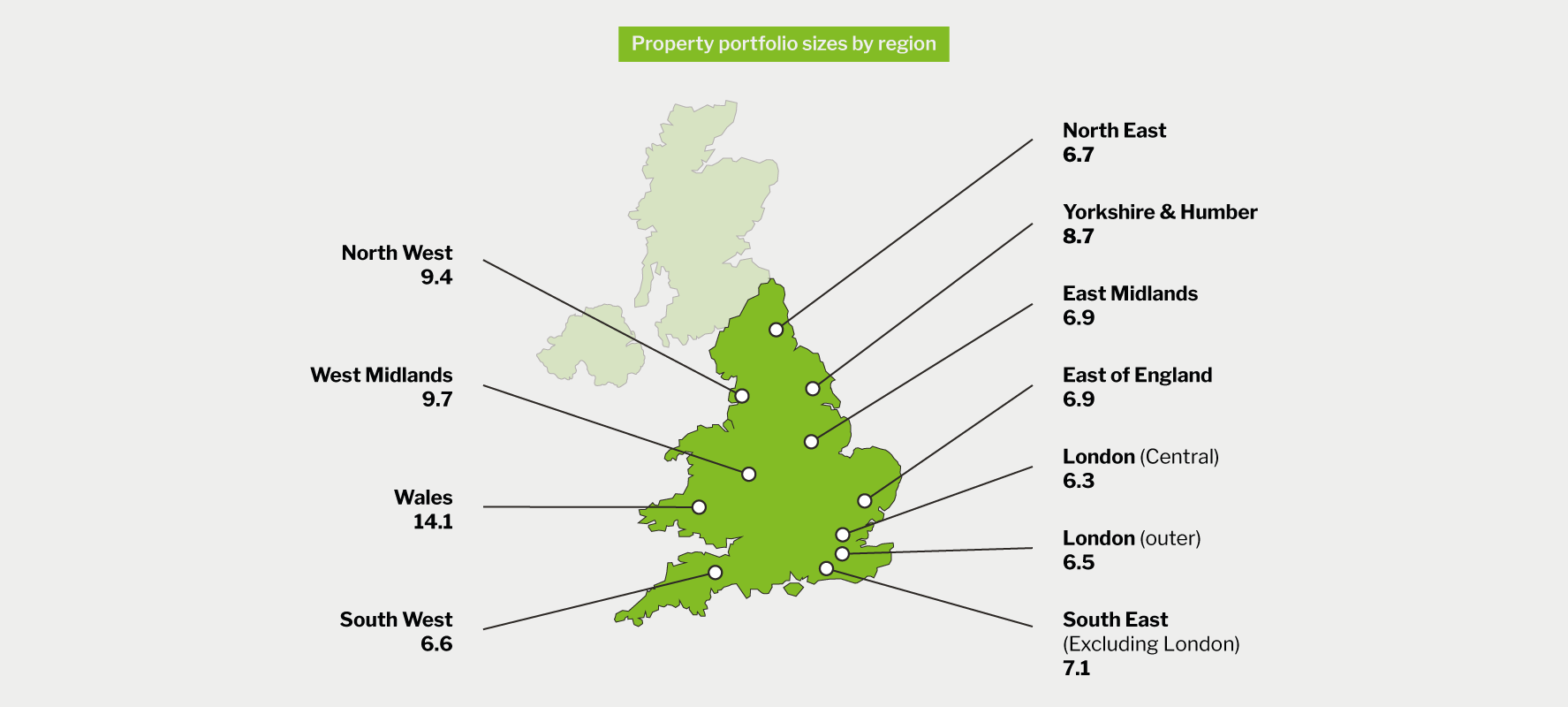

In terms of the number of properties, portfolios vary across England and Wales.

Those in Wales and the West Midlands are managing the largest portfolios, with London-based landlords managing the smallest.

On average, landlords who have financed their portfolio through buy-to-let (BTL) borrowing continue to have larger portfolios (8.4) than their unencumbered peers (5.8), although the difference is narrowing.

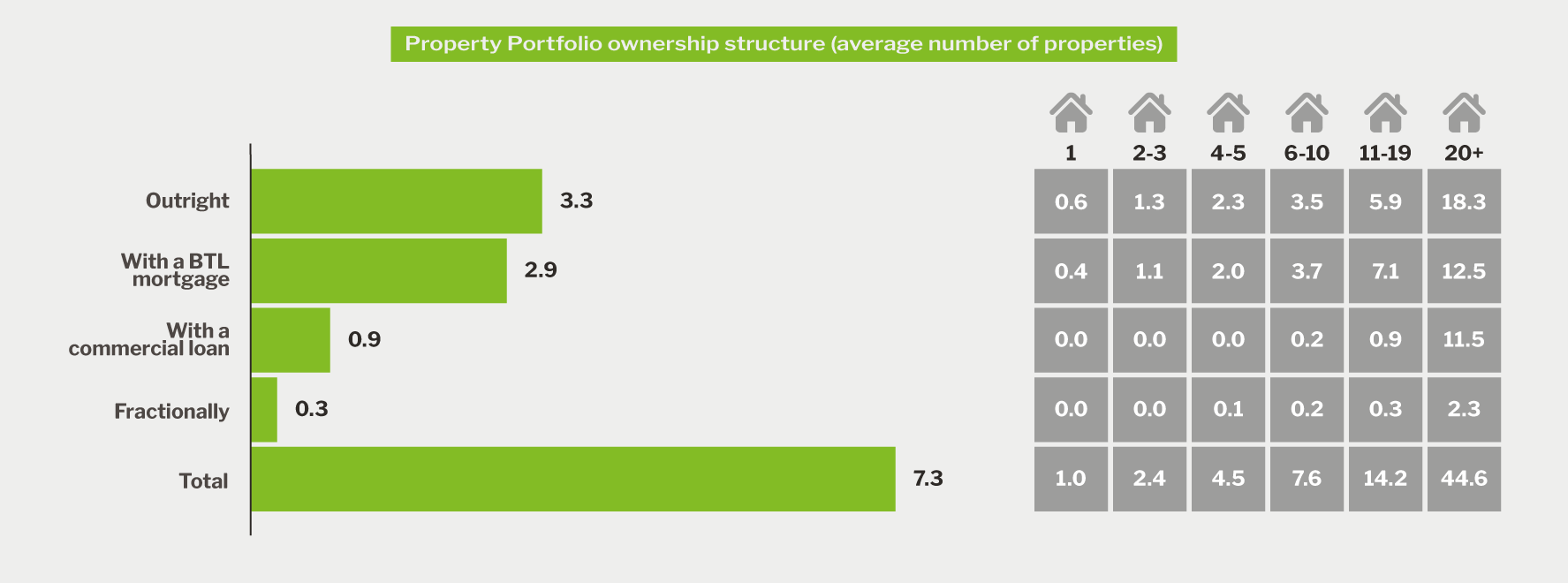

Property portfolio ownership structure

In the average portfolio, 45% of properties are owned outright and 40% are financed with a BTL mortgage. The remaining proportion is divided between properties funded through commercial loans (12%) and those that are fractionally owned (4%).

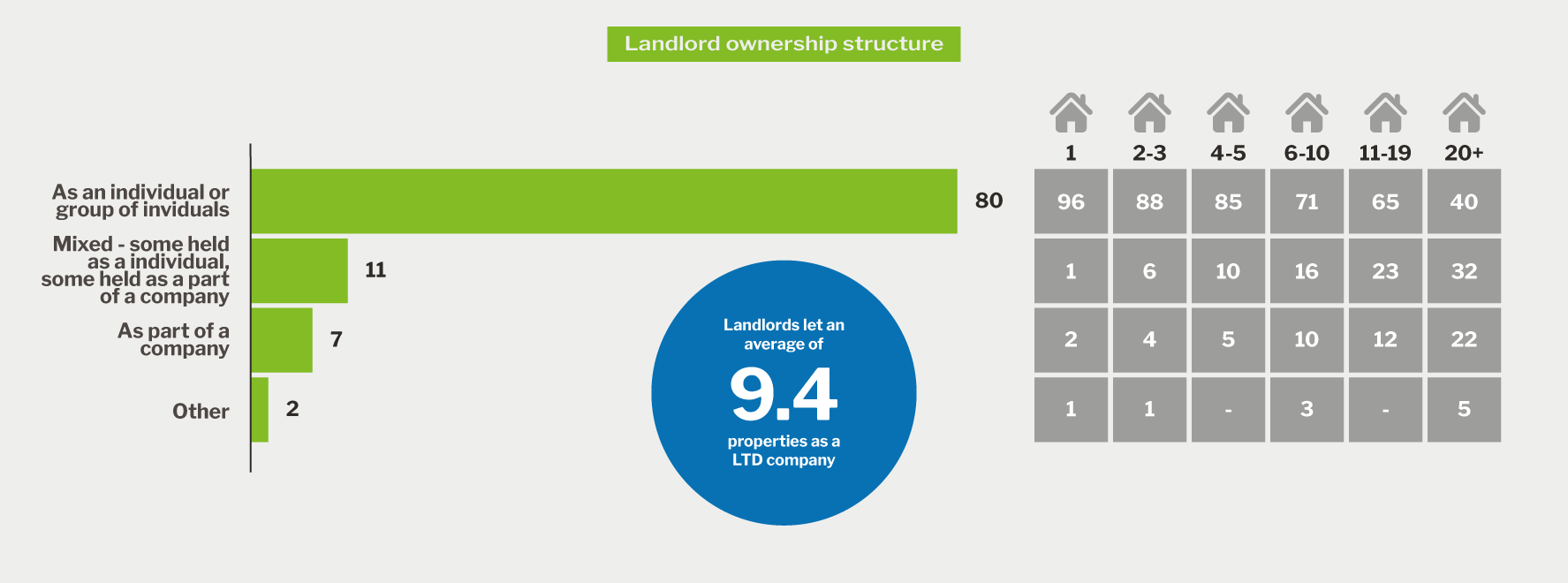

Landlords most commonly manage their portfolios as individuals or groups of individuals (80%).

Limited companies are used by 11% of landlords to hold some of their properties, while 7% use this structure to operate their full portfolio.

Those who do own properties within a limited company have an average of 9.4 held in this way, up from 7.7 last quarter.

Limited company structures increase in prevalence in line with portfolio size, being most common amongst landlords with the largest portfolios.

Tenant demand

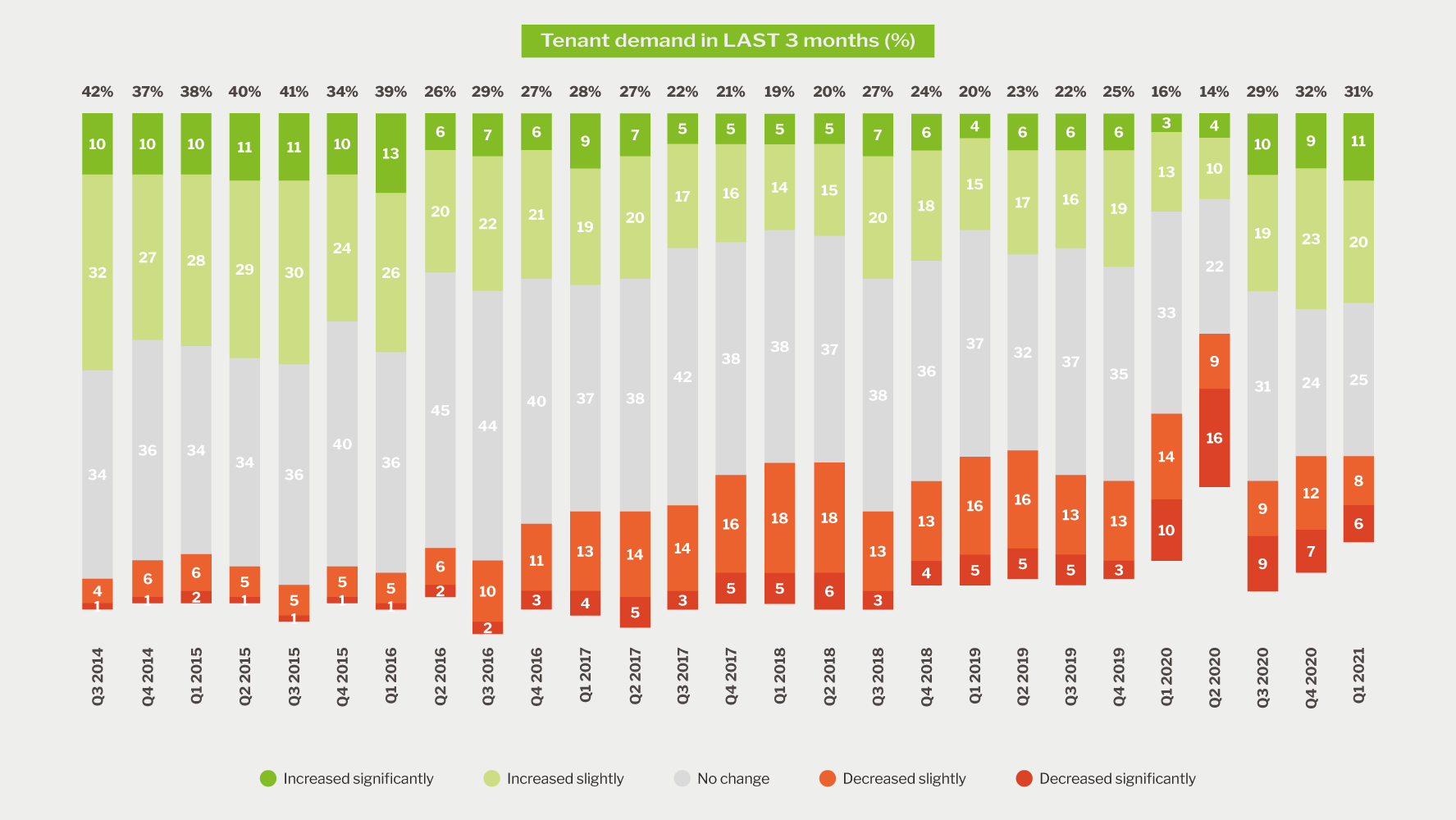

Landlords have indicated a 31% net increase in tenant demand over the past three months. This is down just one percentage point compared to last quarter and is still almost double the 16% increase in demand reported by landlords in Q1 2020.

Despite this sustained period of strong demand, the proportion of landlords who are unsure about current levels of demand has also increased on last quarter, rising from 25% in Q4 2020 to 29% in Q1 2021.

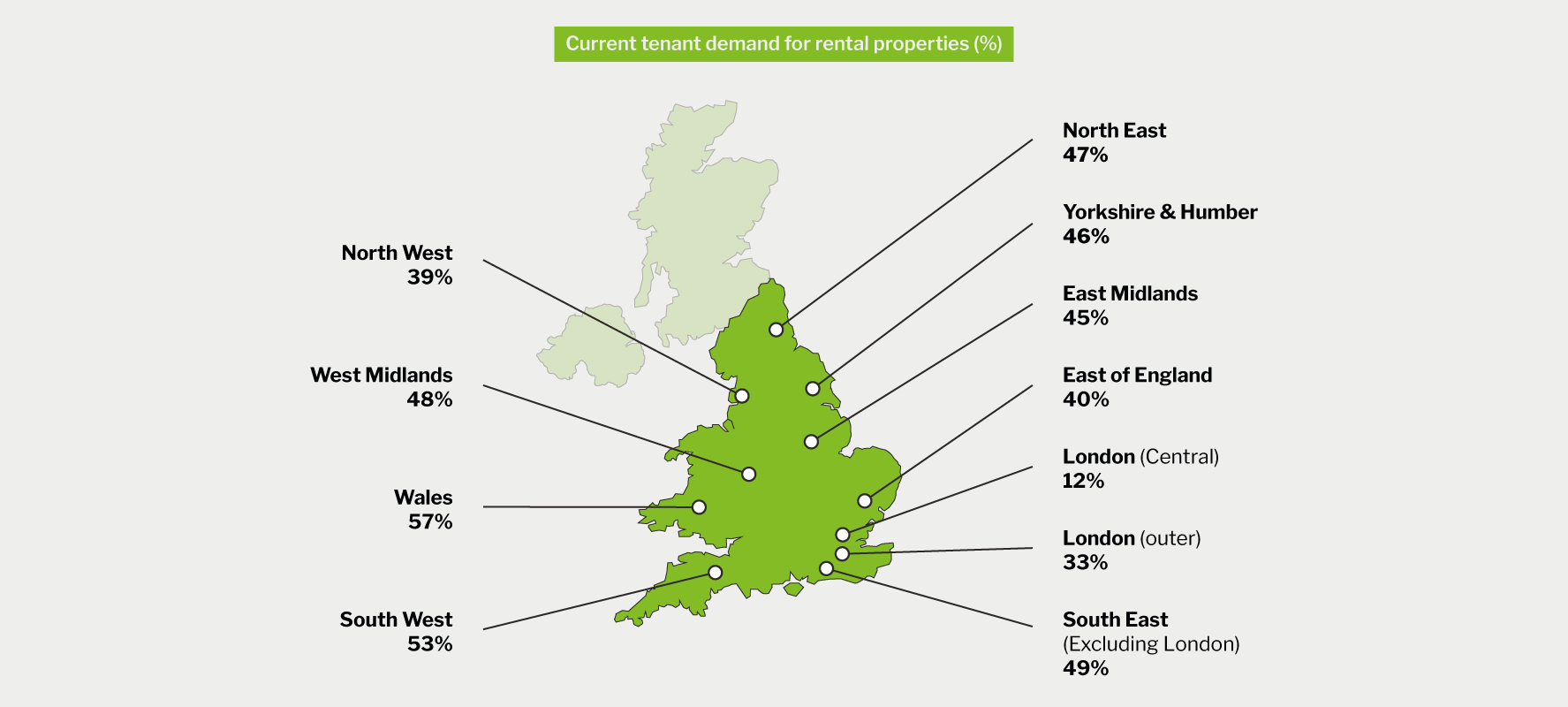

All regions saw an uplift in landlords reporting a significant increase in recent tenant demand when compared to Q1 2020.

This is with the exception of Central London where the small proportion of landlords reporting a slight increase in demand results in a net increase of 12%. A small improvement can be noted however, with the net decrease in tenant demand falling to 55% in Q1 2021 the previous quarter’s 63%.

Yield generation

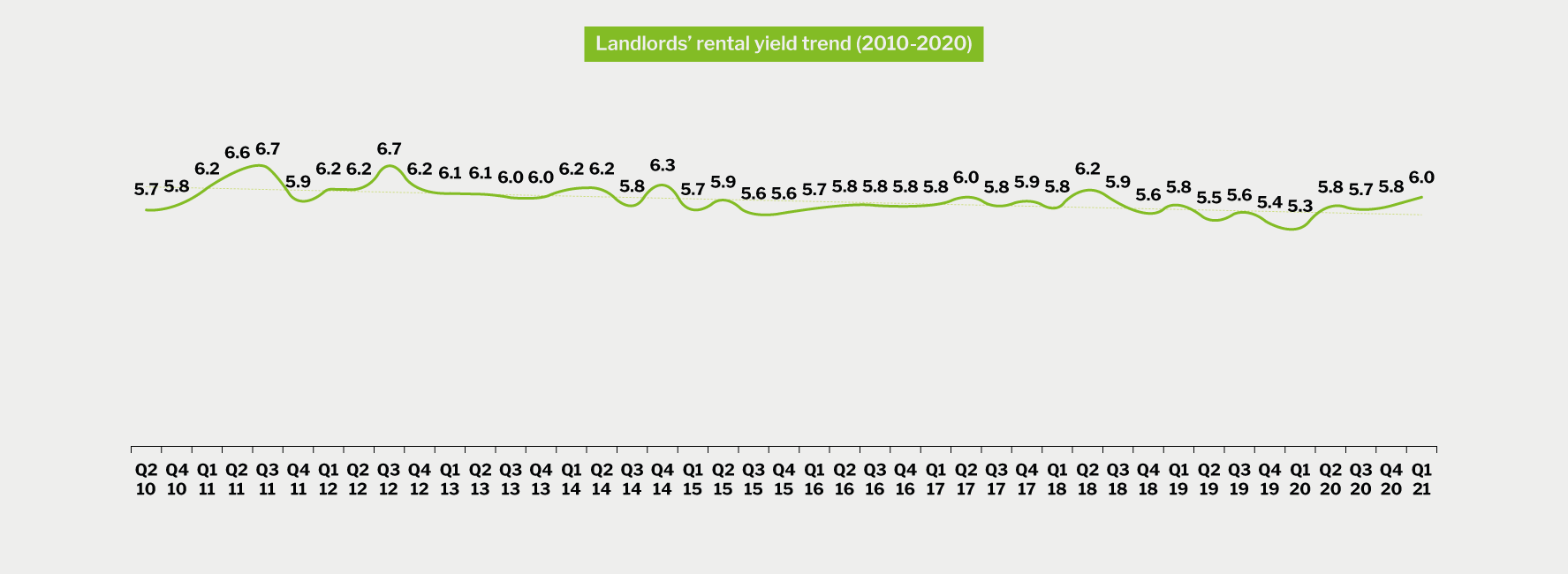

Q1 2021 sees average rental yields hit a 3-year high of 6.0% after an increase of 0.2% percentage points since Q4 2020. It was the second quarter in a row where yields improved.

Landlords’ rental yield trend (2010-2021)

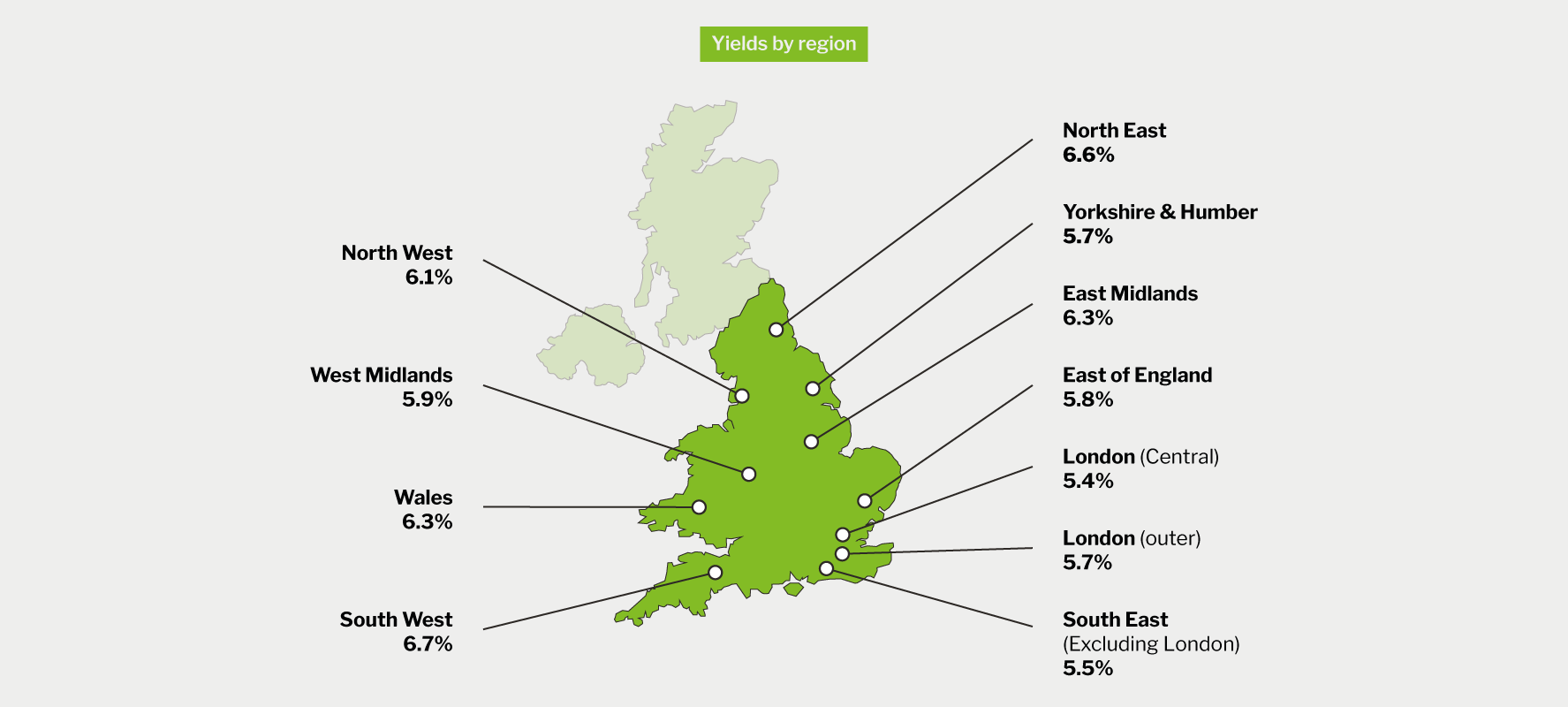

Landlords with properties in the South West achieved yields of 6.7%, making it the location with the highest income generation potential. Marginally lower yields of 6.6% are reported by landlords operating in the North East. Central London portfolios continue to achieve the lowest yields of 5.4%, although this has increased by 3 percentage points on the previous quarter’s 5.1%.

The typical yield generated tends to increase in line with portfolio size, with single property landlords achieving an average yield of just 5.7% versus 7.1% achieved by 20+ property landlords.

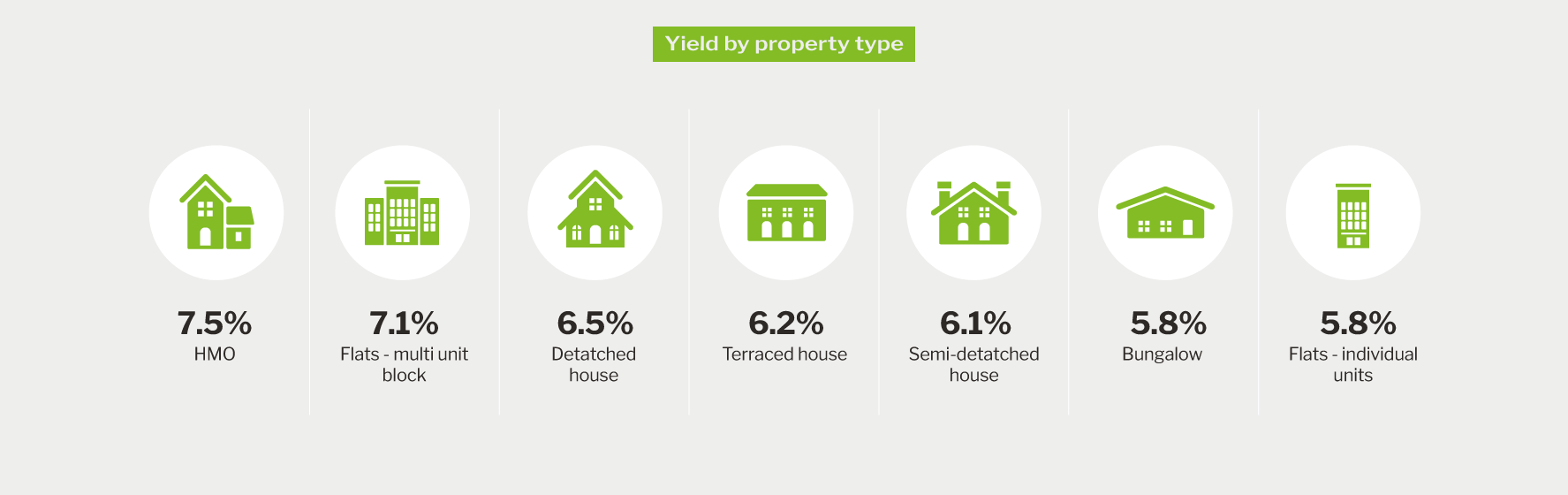

There is also variation in yields across different property types, with HMOs generating the highest average rental yields of 7.5%, while yields of 6.2% can be achieved with terraced houses, one of the most popular investment choices for landlords.

Landlord business expectations

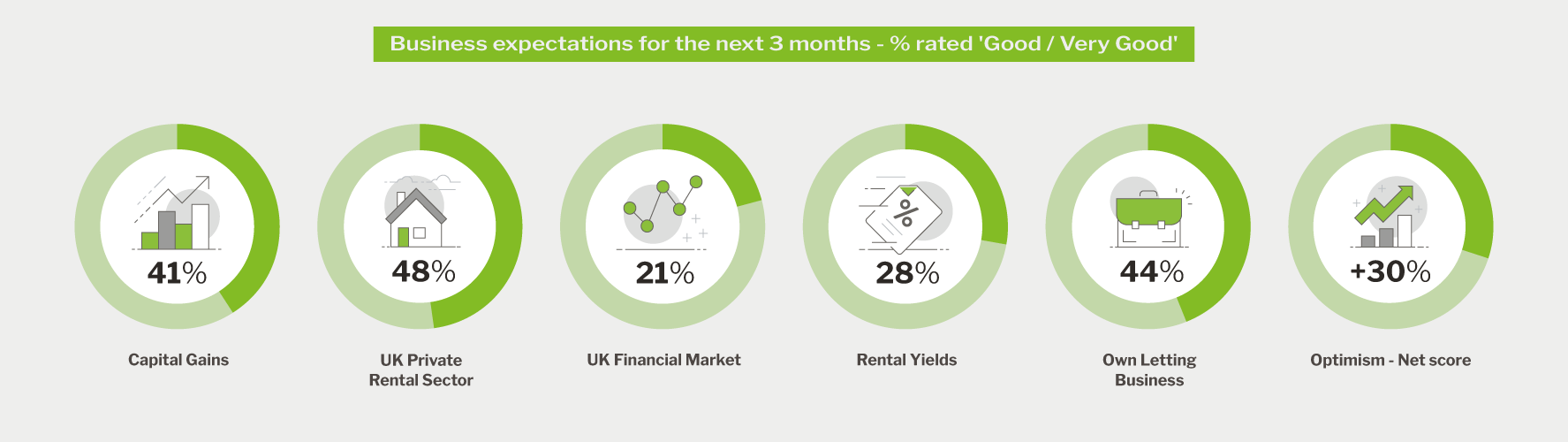

When measured using 5 key business indicators – capital gain, rental yields, UK financial market, UK private rented sector and own lettings business - landlord confidence is considerably higher than it was at the beginning of the coronavirus outbreak a year ago.

The key metric of ‘Net optimism’ for landlord confidence – calculated by combining those who rated their expectations of their own letting business as either ‘Very good’ or ‘Good’ and subtracting those that rated it as ‘Poor’ and ‘Very poor’ - has reached a 3-year high of +30 after climbing 49pts higher than levels recorded in Q1 2020.

Portfolio intentions

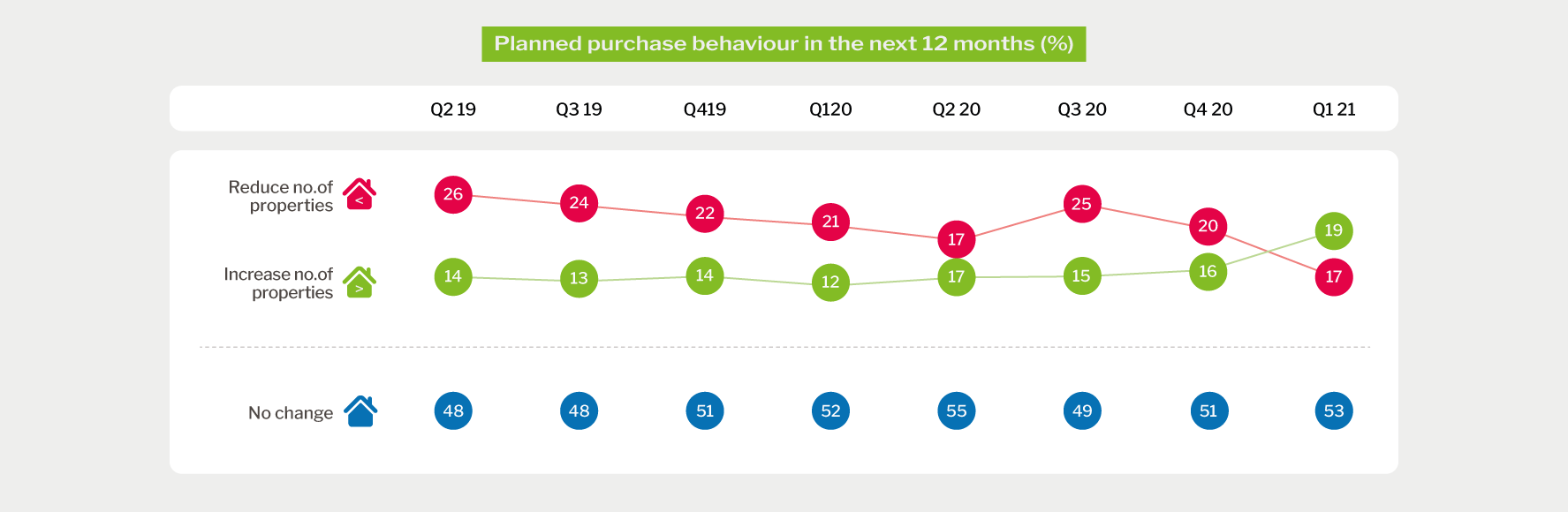

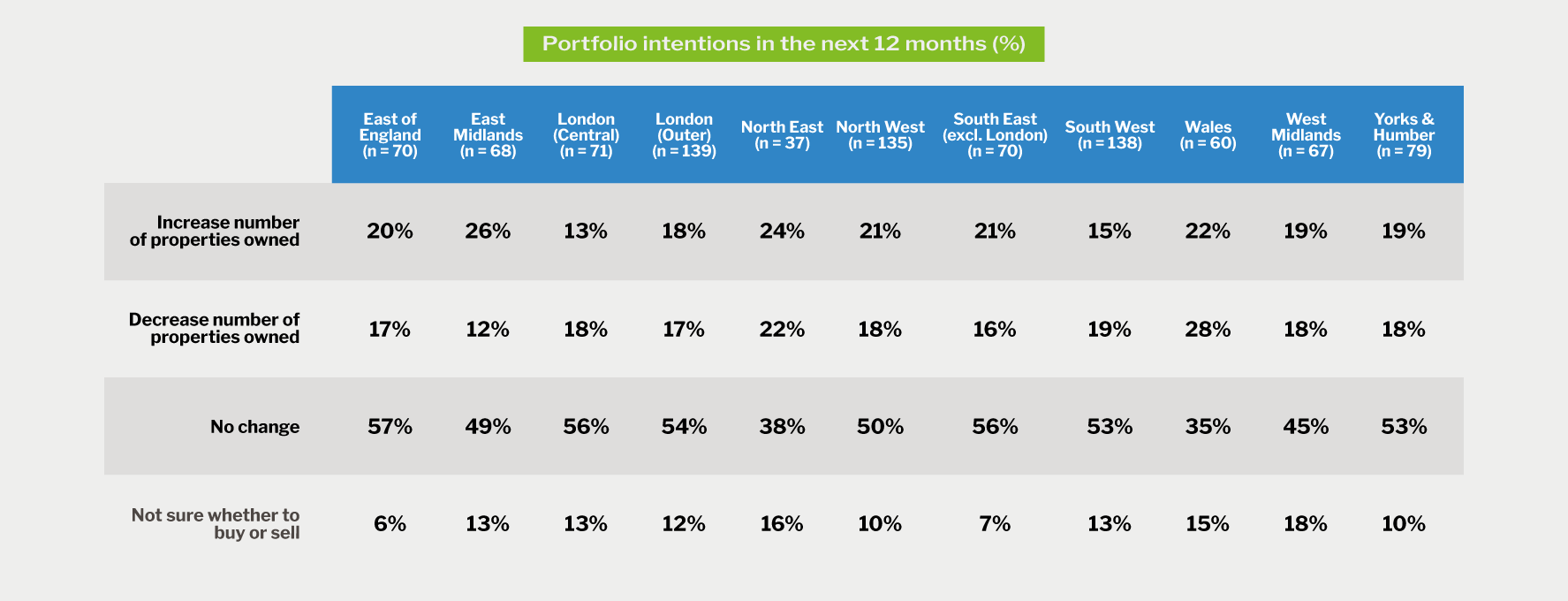

For the first time in four years, the proportion of landlords who say they plan to expand their portfolios (19%) is higher than that who intend to reduce (17%).

Those planning to purchase would like to acquire an average of 2.0 properties each while those reducing their portfolios will divest an average of 2.2 properties.

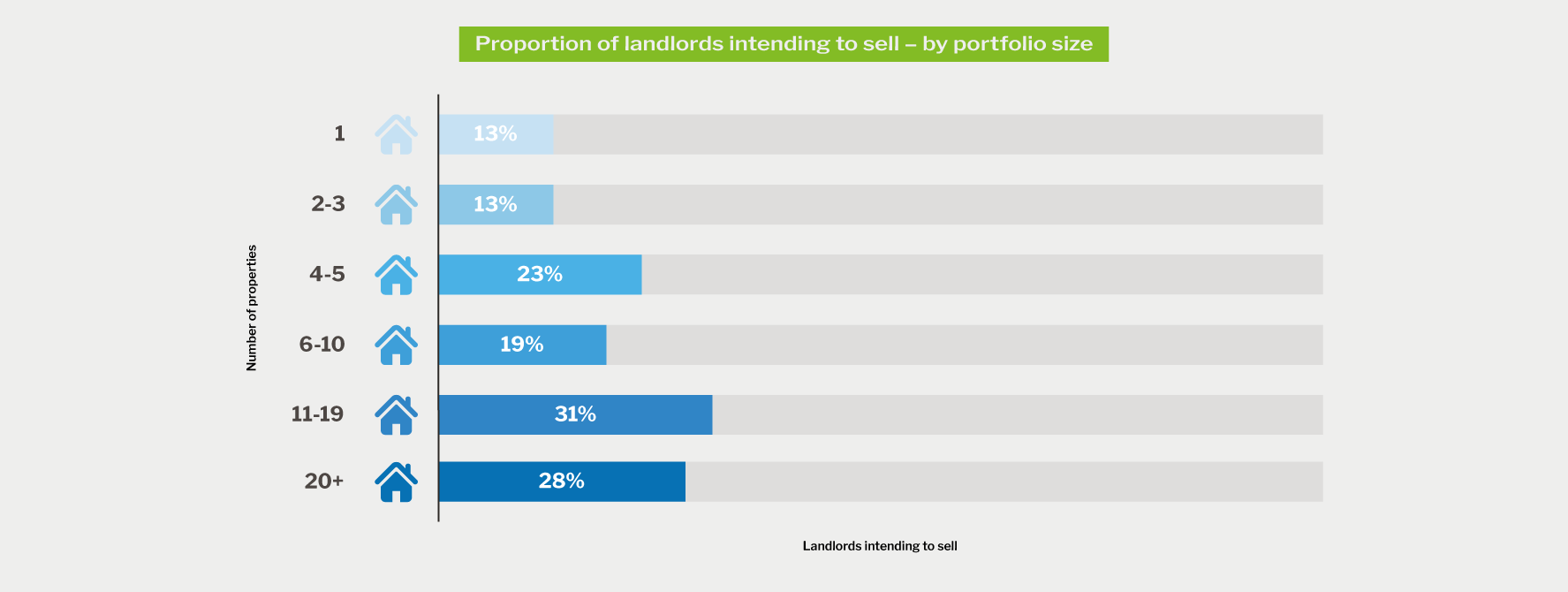

Landlords already managing larger portfolios are most likely to purchase, with 31% of those with 11 to 19 properties and 28% of those who manage 20 or more intending on expanding.

Differences in planned purchase activity also exist regionally. Above average proportions of landlords operating in the East Midlands and North East indicated that they will invest in the future, at 26% and 24% respectively.

Despite being the area with the highest proportion of landlords reporting high tenant demand, Wales is most likely to see private rented sector property sold after 28% of surveyed landlords revealed that they plan to divest in the next twelve months.

Property purchase strategies

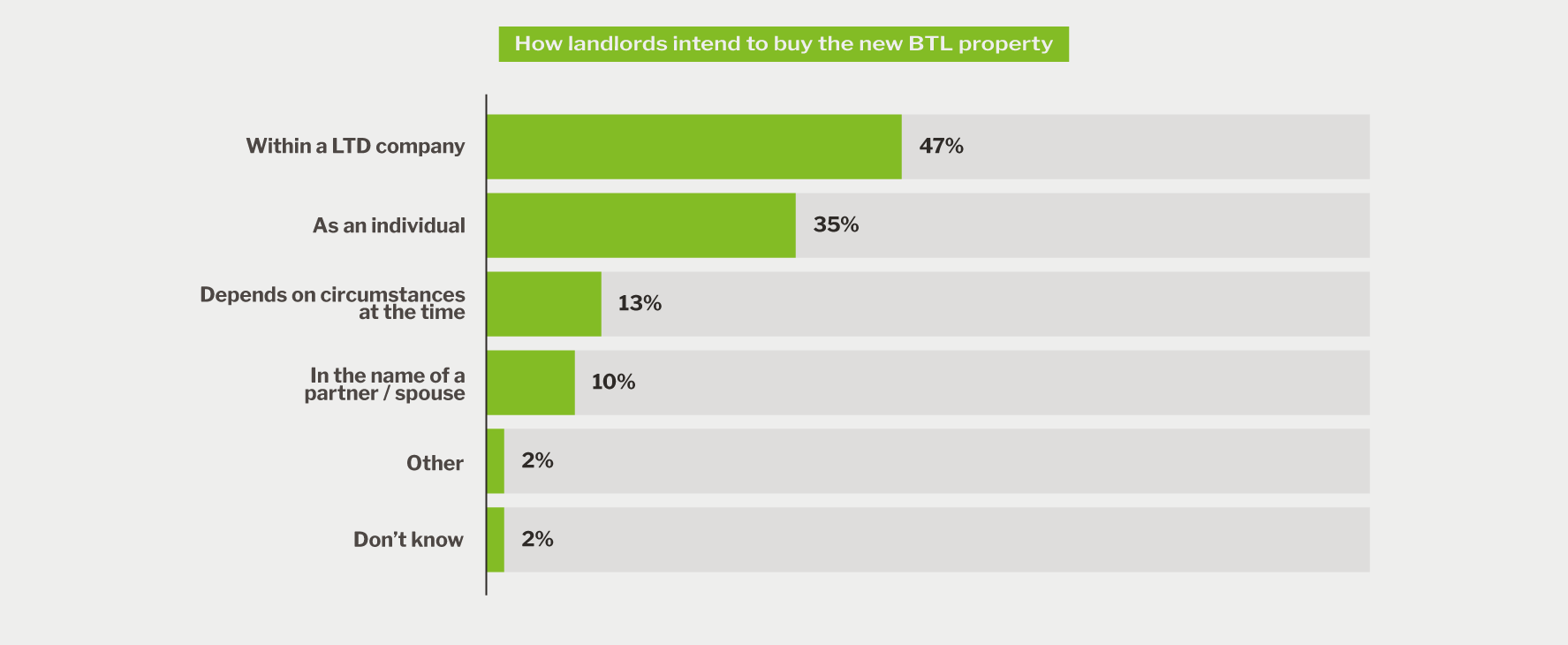

Purchasing a property as a limited company is the most common strategy for landlords, chosen by 47%, followed by buying as an individual, selected by 35% of investors.

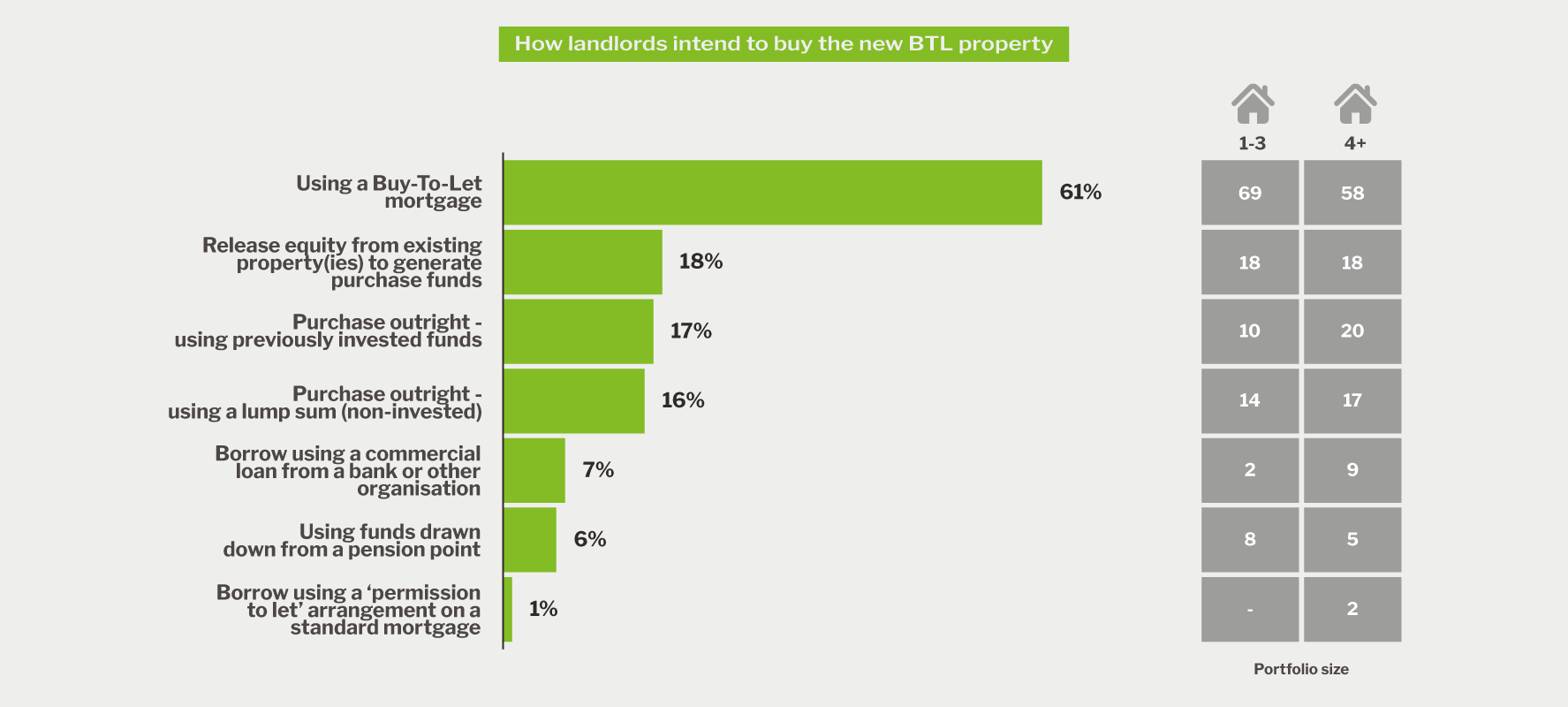

The majority, 61%, of landlords’ next property purchases will be funded through buy-to-let borrowing. The next most popular finance method is the release of equity from existing property, chosen by 18% of investors. This was followed by outright purchase using previously invested funds (17%) or a non-invested lump sum (16%)

To develop the Q1 2021 Private Rented Sector (PRS) Trends report, we worked alongside research agency BVA BDRC. Between March and April 2021, they gained insight through in-depth interviews with just under 900 landlords, in partnership with the National Residential Landlords Association (NRLA).