The North West has become the second largest UK region for buy-to-let purchases behind the South East. So, what’s driven the growth and what makes it attractive for landlords to invest?

The North West has forged its reputation as a great place to live, and many of its cities and towns have benefitted in recent years from investment and regeneration projects. This has helped to transform areas built on manufacturing into forward facing cosmopolitan hubs.

The region now boasts thriving arts, culture and entertainment scenes, which are complemented with world class universities in its two main economic hubs of Manchester and Liverpool.

Its economy has also made great strides, with modern high technology sectors including ICT, pharmaceuticals and telecommunications, sitting alongside its more traditional manufacturing base. Between 2010 and 2018, the North West economy grew by 31.4% and sits only behind London and the South East in size, whilst the region was also the fourth largest beneficiary of inward investment projects last year.

Away from the hustle and bustle, the North West is home to attractive villages that are surrounded by beautiful countryside sat in the shadow of rugged peaks or lapped by lakes.

With so much to offer tenants, the North West has been an attractive location for buy-to-let investors and, last year, more landlords bought new properties in the region than they did in London.

Here, we take a look at some of the factors that make the region such an attractive proposition for landlords.

Strong rental yields

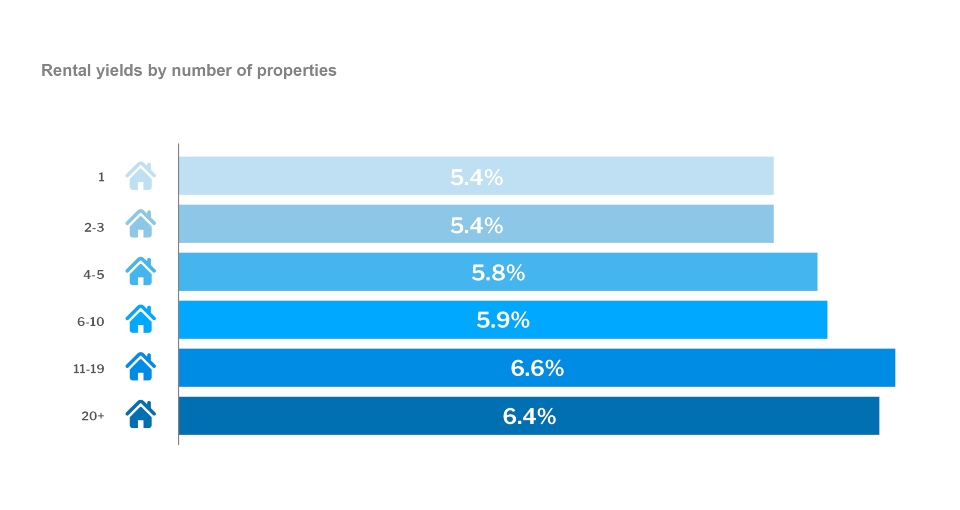

Rental yields can be viewed as one of the most absolute indicators of buy-to-let performance and is one of the North West’s main strengths.

In a survey carried out by BVA BDRC, landlords in the North West indicated that they achieved average yields of 6.5%, the highest of any region in the period recorded (Q2 2020). The average Q2 yield across England was 5.8%, an increase of 0.5% from the historic low of 5.3% in quarter one.

Analysis of Paragon data also shows that the North West is a place where the ratio of rental income to property purchase price is strong. Although the data places the North West in third place behind the North and Wales in terms of yield, the region delivers more favourable average yields of 7.11% compared to BDRC’s numbers.

Landlords letting to migrant workers indicate that they achieve the highest rental yields, at an average of 6.8%. This may be an important factor in the region’s yield performance as it has the third highest migrant population in the country, with only London and the South East being home to more people born outside of the UK.

Liverpool and Manchester are also in the top ten UK cities with the most universities and, when added to others across the region such as Lancaster, we can see the North West’s many universities may well play a part in this too with student lets being consistently strong performers in yield generation.

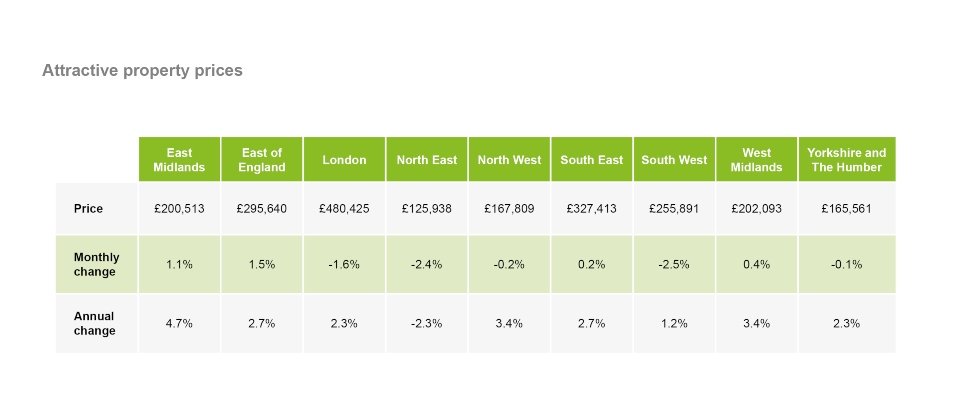

Attractive property prices

A key factor in yield performance is the price paid for property and the North West benefits from lower than average property prices.

According to the latest Land Registry UK House Price Index, the average property price in the North West was £167,809, which is significantly lower than the UK average of £234,612. Only those in neighbouring regions will pay less for property with averages in the North East at £125,938 and Yorkshire and the Humber at £165,561.

Source: HM Land Registry - UK House Price Index summary: April 2020

Source: HM Land Registry - UK House Price Index summary: April 2020

Stability

A less exciting but important aspect of the North West’s buy-to-let market strength that shouldn’t be overlooked is the region’s stability. Rental and property price inflation is typically less volatile than other regions, making it a stable environment for landlords to invest, and this is reflected in the levels of business in that market.

Following the introduction of three Government initiatives midway through the last decade - tax relief on finance costs, Stamp Duty Land Tax (SDLT) changes and Prudential Regulation Authority (PRA) underwriting standards for buy-to-let mortgages – buy-to-let lending for new purchases across most regions has declined. However, the North West remained relatively stable in terms of loans for house purchases.

While the North West has seen low levels of rental inflation, not exceeding 1.5% over the past five years, it has benefitted from generally stable levels.

Source: ONS

Affordability

Low rent inflation should not automatically be seen as a negative as it’s only part of the picture and other factors should be taken into account when considering the strength of the region.

One of these is affordability because the ratio of rent charged to salary earned impacts demand and rent inflation.

On average, people in the North West pay £610 per calendar month (pcm) in rent. This is 26% of the average salary in the region, which makes the North West more affordable compared to the England average where renters typically pay 29% of their salary.

The only regions where rents are more affordable are the North East where tenants pay on average £514, or 23% of average earnings, followed by Yorkshire and the Humber where average rents are £589 pcm which equates to 25% of average earnings.

The affordability of the North West makes it an attractive region for tenants, supporting healthy demand, and this means that there is headroom for any rental increases to be absorbed without a significant negative impact. This is perhaps supported by landlord intent because according to BVA BDRC survey findings, those operating in the North West were most likely to see increases in rents in the next 12 months.

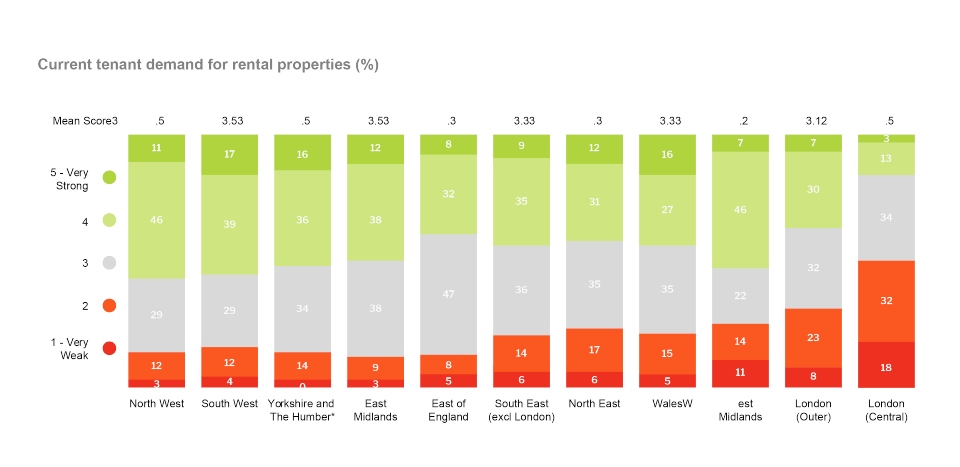

Strong levels of tenant demand

Strong demand is reported by 57% of landlords with properties in the North West, the highest of any UK locality. To provide some comparison, the lowest demand is seen by landlords in Central London where only 16% deem it to be strong and 50% say demand is weak.

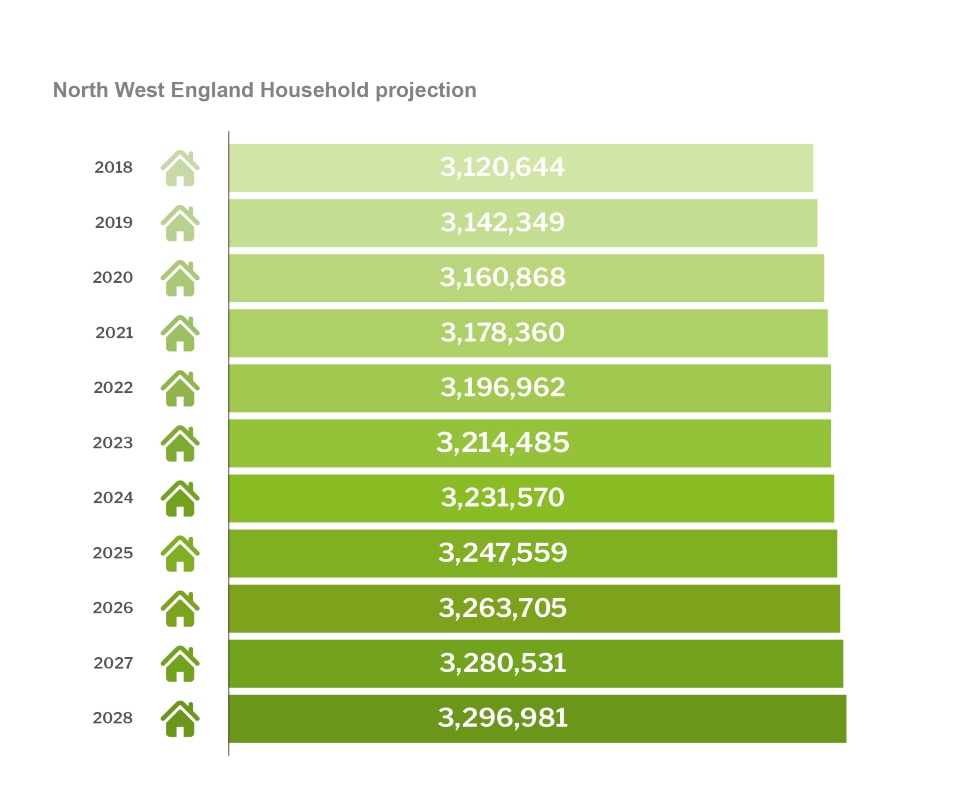

ONS 2018-based household projections forecast a change from 31,20644 households in 2018 to 32, 96981[MC1] households in 2028, an increase of 5.6%